Moving money is fast and free with Interac® e-transfers

Send and receive money safely and freely to anyone in Canada with your KOHO account.

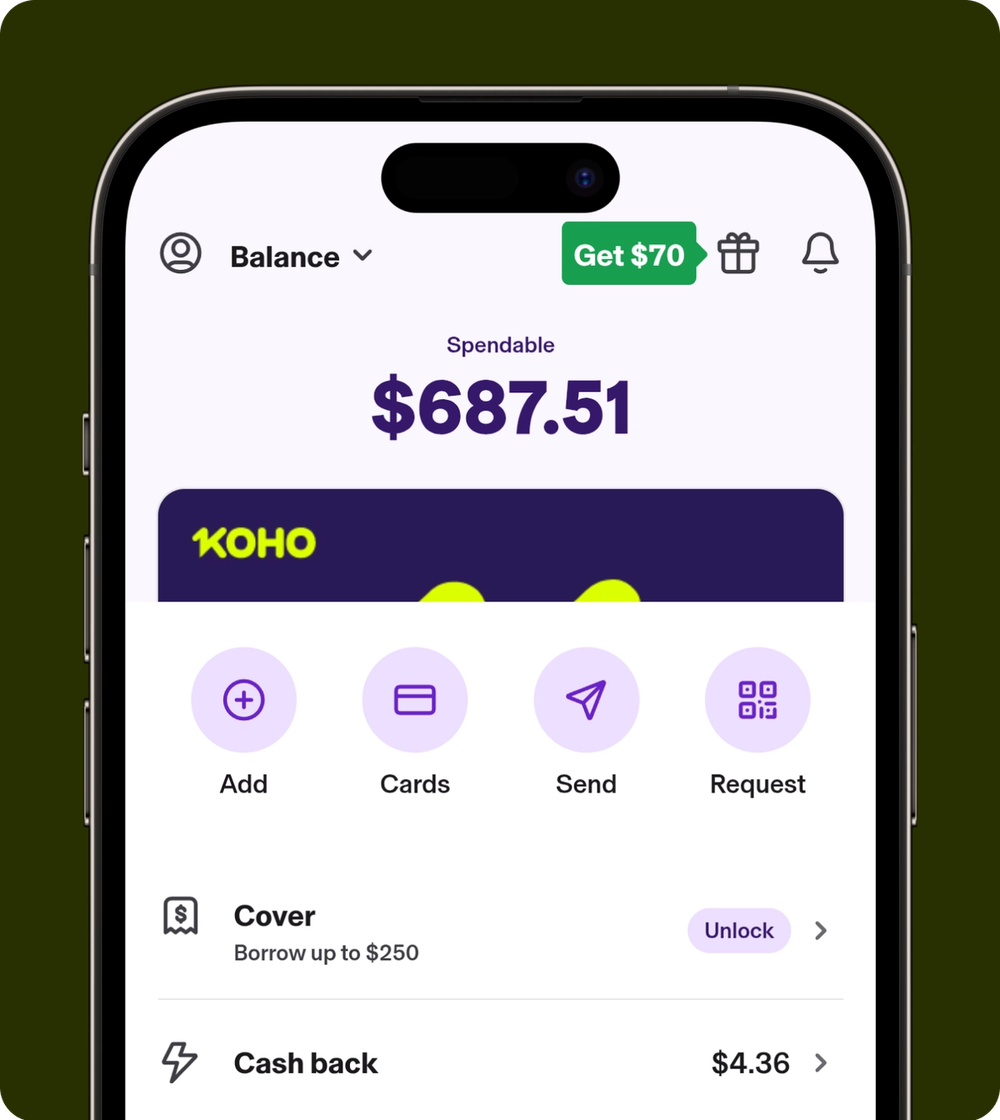

Send Interac e-Transfers with KOHO

Send as many e-Transfers as you want without paying a cent.

Send Interac e-Transfers any time day or night.

With multiple layers of security, Interac e-Transfers are one of the most secure money transfer services globally.

Get money deposited automatically to your account, no security questions needed.

More ways to move money

Save on every e-Transfer

Unlike most financial institutions, every Interac e-Transfer you make with KOHO is free. See how we compare:

| KOHO | Traditional Banks | |

|---|---|---|

| Send e-Transfer | Free | Up to $1.50 |

| Stop e-Transfer | Free | Up to $3.50 |

| Request Money | Free | Up to $1.50 |

| KOHO | Traditional Banks |

|---|---|

| Send e-Transfer | Free |

| Stop e-Transfer | Free |

| Request Money | Free |

Pick a plan and try it with no cost

All KOHO plans come with a free 30 day trial so you can see if it suits you.

The perfect plan for your needs | Essential Over $100/year in value³$0/mo² | Everything Over $500/year in value³$14.75/mo | |

|---|---|---|---|

Benefits | |||

| Unlimited cash back on groceries, transportation, food & drinks | 1% | 1.5% | 2% |

| Earn interest | 2% | 2.5% | 3.5% |

| Free Credit Score | |||

| Instant e-Transfers | |||

| No Foreign Transaction Fees | - | ||

| Discount on Credit Building | - | 30% | 50% |

| Advanced phone support | - | - |

Not sure which one speaks to you? Take our quiz to find the best plan for you.

Find a planE-Transfers make your life e-asier

Using KOHO to send and receive Interac e-Transfers is perfect for:

FAQS

An Interac e-Transfer is a fast, secure, and convenient way to send money to anyone in Canada with your KOHO account.

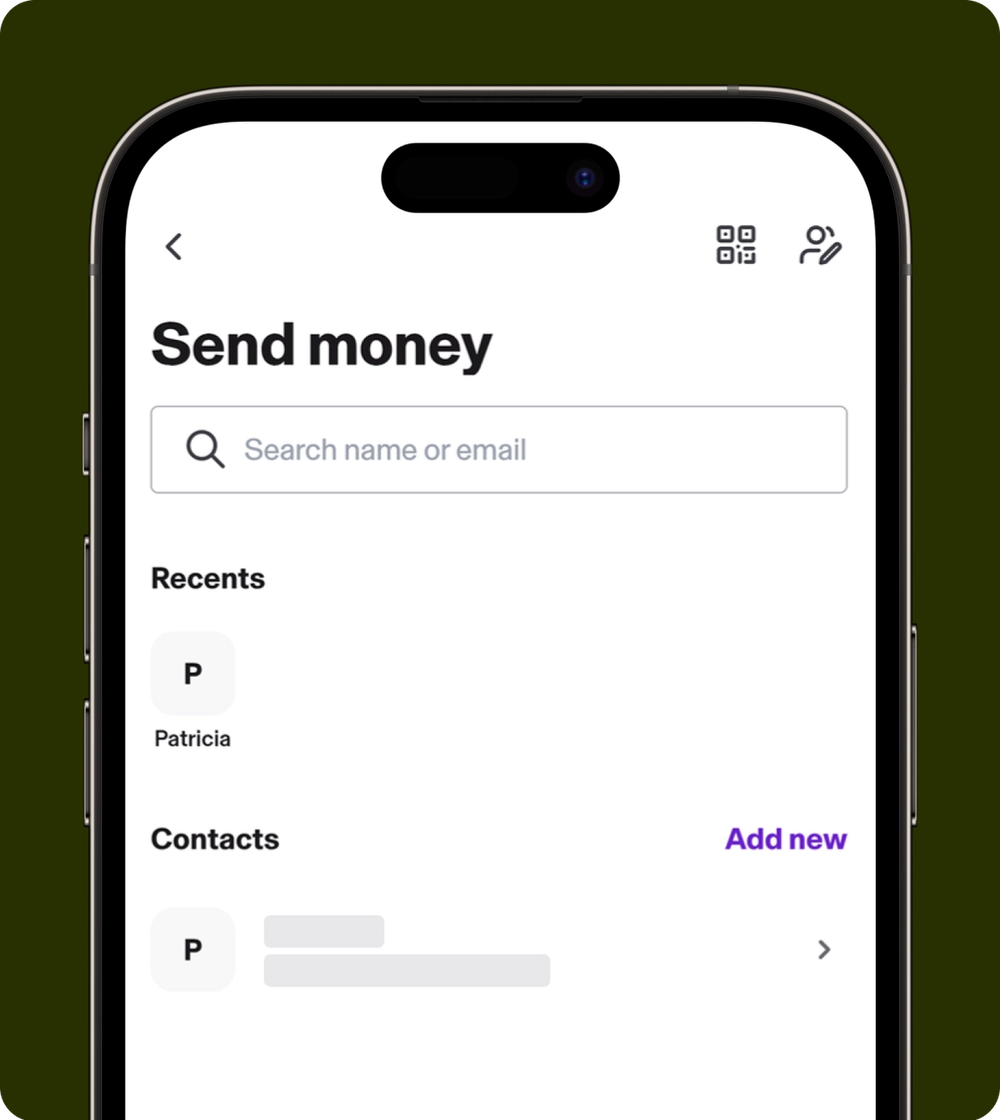

You can request money from someone else through their email address or phone number. They can then send money to you securely with an Interac e-Transfer.

It’s easy! Just follow these instructions:

- Log into your KOHO app > click Add money > e-Transfer > scroll down to Personal > set-up Autodeposit

- Enter the primary email you wish to register for auto-deposit

- Check your inbox for the verification email, and click the link to complete the registration

- Done!

All future Interac e-Transfers sent to that email address will be deposited to your KOHO account.

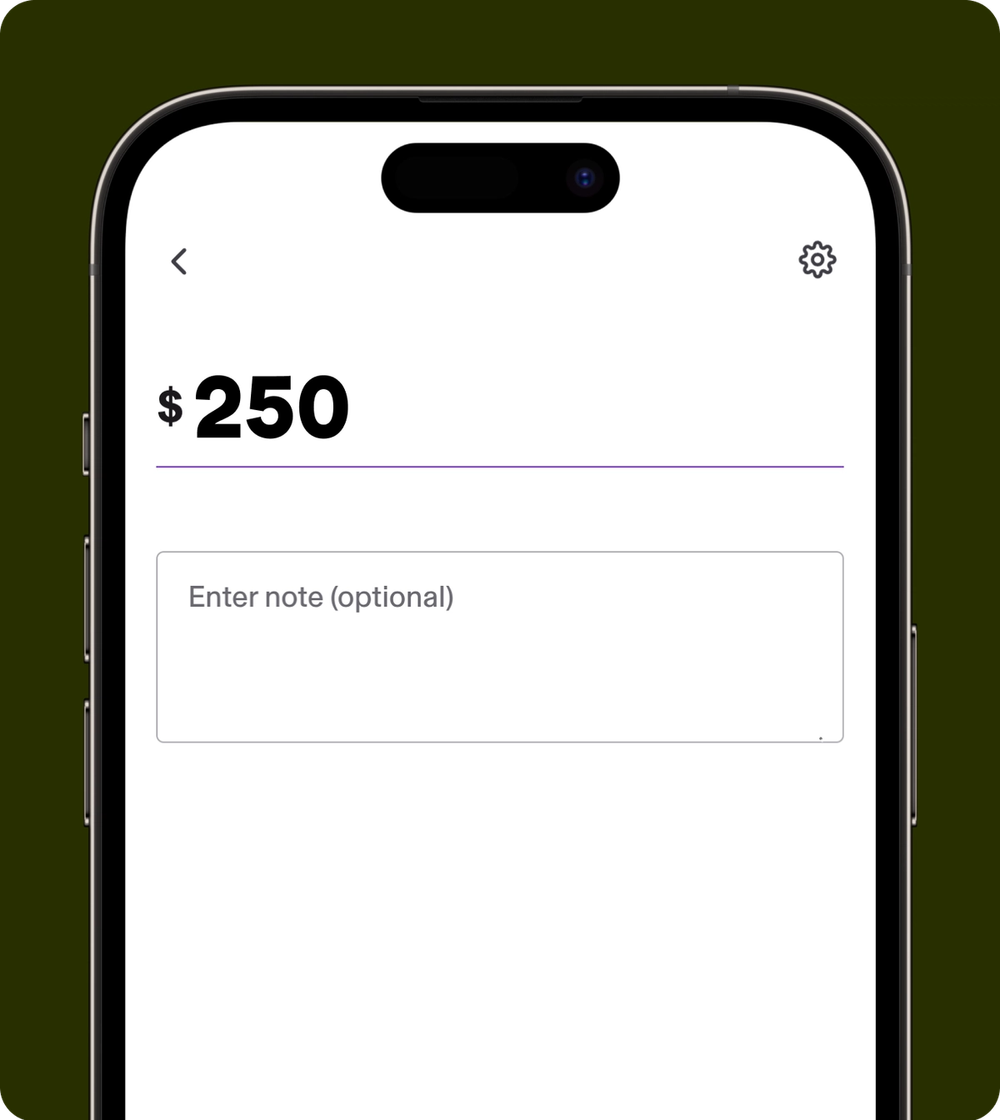

If you need to cancel an e-Transfer sent from your KOHO account, just follow these steps in-app:

Tap the ‘$’ icon, and then choose ‘Pending transfers’.

If it's still possible to cancel this e-Transfer, you'll see it listed under "Transfers Sent"

Select Cancel > Cancel Transfer > Yes > You're all set!

If you're unable to cancel this transfer, then it's ineligible for cancellation. Our support team won't be able to cancel this on your behalf.

Good-to-know: If you've sent an Interac e-Transfer to a recipient with auto-deposit, it also won't be possible to cancel this e-Transfer

The recipient should receive the money within 30 minutes.

It’s very safe. Interac e-Transfer users are protected by multiple layers of security, making them one of the most secure money transfer services in the world. The receiving and sending bank or credit union transfer the funds to each other using established and secure banking procedures.

Unfortunately you can’t increase your limit on e-Transfers. The good news is the amount you can use is already quite high! You can make 20 Interac e-Transfers per day, and 120 per month. You can receive up to $10,000 per transaction and per day, and receive a total of $40,000 per month. The amount you can send per transaction and per day is $3,000.

Still have questions?

Can't find the answer you're looking for? Please chat to our friendly team.Visit our FAQs

4 min read

Learn the simple steps to transfer money between bank accounts. Discover various methods such as online transfers, wire transfers, and mobile banking apps. Gain confidence in managing your finances efficiently and securely.

4 min read

You deserve to know exactly how secure your money is when you hit "send."