International Money Transfer

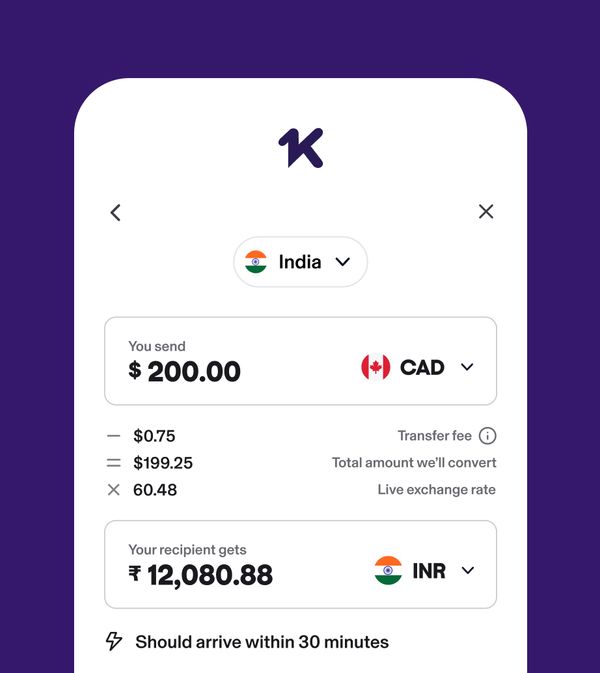

Sending money across borders can be expensive and full of surprises. With KOHO, International Money Transfer is always fast and secure with no hidden markups or other-worldly fees.

Save on transfer fees

So what makes up a transfer fee? For many banks and providers, it’s the exchange rate, a markup (a hidden fee) and a service fee.

We’re different from others. We use the live exchange rate for every International Money Transfer–that’s the best rate around for most countries.

And we never add any hidden fees, so more money reaches your destination. What you see is always what you get.

Transfer money overseas

No more standing in line at the bank, paying big fees or waiting days for your money to arrive.

Finding the best price for your International Money Transfer can be a lot. Check out how you much you save with KOHO compared to popular providers*.

Example

CAD

INR

Exchange Rate (Live)

60.48

Transfer Fee (Transparent fee)

$1.07

Exchange Rate (Hidden fee)

58.89

Transfer Fee

$0

Exchange Rate

59.93

Transfer Fee

$3.28

Exchange Rate

59.65

Transfer Fee

$1.99

Provider | Exchange Rate  CAD >  INR | Transfer Fee |

|---|---|---|

KOHO | 60.48 Live exchange rate | $1.07 Transparent fee |

PayPal | 58.89 Hidden fee | $0 |

Wise | 59.93 | $3.28 |

Remitly | 59.65 | $1.99 |

How to send money abroad with KOHO

Pick a plan and try it with no cost

All KOHO plans come with a free 30 day trial, so you can see if it suits you.

The perfect plan for your needs | |||

|---|---|---|---|

Benefits | |||

| Unlimited cash back on groceries, transportation, food & drinks | 1% | 1.5% | 2% |

| Earn interest | 2.5% | 3% | 4% |

| Free Credit Score | |||

| Instant e-Transfers | |||

| No Foreign Transaction Fees | - | ||

| Discount on Credit Building | - | 30% | 50% |

| Personal Phone Support | - | - |

* Get Essential for free! Learn more

**This is an estimate. Actual savings may vary depending on individual spending habits and service usage

The best way to send money online

Whether you're helping family back home, paying for services abroad, or sending money to friends–we've made it simple, affordable and fast.

Best exchange rates

Get one of the lowest exchange rates around for the Philippines, India, Pakistan, USA, Mexico and EU, and competitive rates for other countries**.

No hidden fees

We never add any hidden fees (like a markup) to the exchange rate, so our fees are usually lower than others. What you see is always what you get, so more money reaches your destination.

Fast global transfers

Speed matters. Get money to your people within 30 minutes***. Set up transfers in a few taps and track them in real-time. Because when someone’s waiting, your money shouldn't take the scenic route.

Our members say it best

Got questions about International Money transfer?

Also known as a remittance means sending money from one country to another. With KOHO, you can send Canadian dollars to family, friends, or businesses in 190+ countries around the world, and they'll receive the money in their local currency.

It depends on where you're sending the money, but we’ve made it pretty snappy. Most transfers to popular countries like the Philippines, India, and Pakistan, arrive in minutes to a few hours. Other destinations usually take 1-2 business days.

We'll always show you the estimated arrival time before you transfer, so there are no surprises.

Sending with KOHO is the way to go. We offer some of the best exchange rates around, especially for popular destinations like the Philippines, India, Pakistan, USA, Mexico, and the EU.

Unlike banks and other providers, we don't add a hidden markup to the exchange rate. So what you see is actually what you get. Our transparent fees means you always know exactly what you're paying before you send the money.

Sending money with KOHO is super simple: 1. Sign up for a KOHO plan (if you haven't already) 2. Find “Send money” in your app and then "Send internationally" 3. Enter your recipient's details and how much you want to send 4. Review the exchange rate and our service fee 5. Confirm and send!

Your recipient gets notified when the money is on its way, and you can track the transfer right in your app.

For now, you can send up to $5,000 CAD daily, and up to $15,000 CAD monthly****.

For most countries you can send the money by direct deposit and they’ll receive it to their bank account. There are some more options available for some countries, which you’ll see when you set up the transfer.

The best way is the one that gives you the most value for your money with the least hassle. Unlike traditional banks that add a hidden markup to exchange rates and charge high service fees, we keep things transparent and affordable.

Our app makes the process quick and easy, with real-time tracking so you always know where your money is and when it’ll arrive. Plus, we’ve made the most popular destinations extra speedy, so your money arrives faster compared to many other providers.

We've kept it simple. For most transfers, you'll just need:

- A KOHO account

- Your recipient's full name as it appears on their ID

- Their bank account details

Maybe we’re biased, but we think KOHO is your best bet when sending remittances!

Here's why:

- A simple app where you can send money in a few taps

- Real-time tracking of your transfer

- Some of the best exchange rates in Canada

- No markup or hidden fees

- Fast delivery times

- 24/7 customer support right in the app

Plus, no need for any other money management apps, you can do it all in KOHO.

Welcome to Canada! KOHO is perfect for newcomers because it has International Money Transfer and so much more.

With KOHO, you also get:

- A prepaid Mastercard that works everywhere

- Up to 2% cash back on everyday purchases

- High-interest savings (up to 4% on your entire balance)

- Credit building features to help get started with your Canadian credit history

- Our Essential plan for $0

- Budgeting tools to help you manage your money

- No foreign transaction fees and free international ATM withdrawals on our Everything plan

- eSIM with up to 3GB of data to connect wherever you are, and

- Tenant Insurance to stay protected

The latest from our blog

News, stories and thoughts on money management

4 min read

Learn what a remittance is and how international money transfers work.

5 min read

Discover the best ways to send money internationally.

4 min read

Learn how to send money overseas from Canada as a newcomer.

*The exchange rates and fees displayed in this comparison chart are for informational purposes only and are subject to change without notice. The rates and charges listed are based on publicly available information at the time of compilation and may not reflect real-time pricing, promotional offers, or other factors affecting the final cost of a transaction. We do not guarantee the accuracy, completeness, or reliability of the information provided, and users should verify current rates and fees directly with the respective financial institutions before making any transactions. Terms and conditions apply.

**Rates compared to standard rates provided by major banks, excluding promotional, special, and limited-time offers.

***Transfers to most countries are processed within 30 minutes but could take longer. Terms and Conditions apply

****Account specific limits and restrictions may apply.