Guaranteed approval to build your credit

No interest. No credit checks.

+2.8M

Credit score point increase for 150K users

0%

The Interest you get charged

+31 points

Average credit score increase

400K+

Canadians that have built with us

+2.8M

The total credit score point increase seen by 150K users in the past 12 months

0%

The Interest you get charged

+31 points

Average credit score increase for users after 4 months*

400K+

The number of Canadians that have built credit with us

What is credit building?

Build more with KOHO Credit Building

With our different Credit Building tools, you can make progress on all of the factors that influence your credit score.

Payment History

Shows how consistently you make on-time payments for things like bills, loans, etc.

Utlization Rate

Shows the percentage of your available credit that you’re using.

Credit Age

This tracks how long you’ve been using credit. An older “age” will help improve your score over time.

Credit Mix

This represents the different types of credit accounts you have. A more diverse mix of accounts can show responsible use of different credit types

Why Build Your Credit?

A strong credit history increases your chance of getting better rates on loans.

You could qualify for better credit cards with lower interest, no monthly fees and other benefits.

With a stronger history, you'll see opportunities for new financial products you couldn't previously access.

Start building your credit history today

Start making progress towards your financial goals, and make the most of your savings.

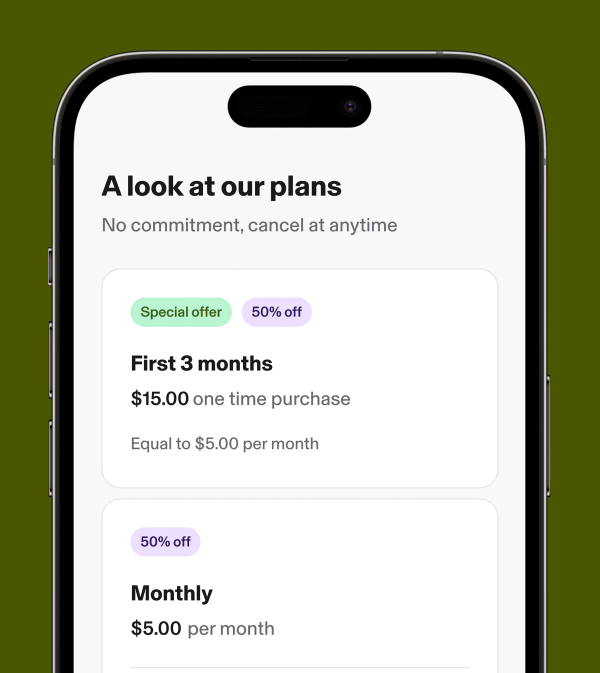

The perfect plan for your needs | Essential Over $100/year in value³$0/mo² | Everything Over $500/year in value³$14.75/mo | |

|---|---|---|---|

Benefits | |||

| Unlimited cash back on groceries, transportation, food & drinks | 1% | 1.5% | 2% |

| Earn interest | 2% | 2.5% | 3.5% |

| Free Credit Score | |||

| Instant e-Transfers | |||

| No Foreign Transaction Fees | - | ||

| Discount on Credit Building | - | 30% | 50% |

| Advanced phone support | - | - |

READY TO START BUILDING?

Join over 400,000 Canadians who have used KOHO to strengthen their credit history.

The reviews speak for themselves

We’ve earned the trust of more than 2 million Canadians using KOHO—not to mention their praise.

FAQS

KOHO gives you an affordable way to make or build your credit history in Canada. There are no deposits, hard credit checks, or applications. And you’re guaranteed approval. Head to your KOHO app and click Credit > Register to get going.

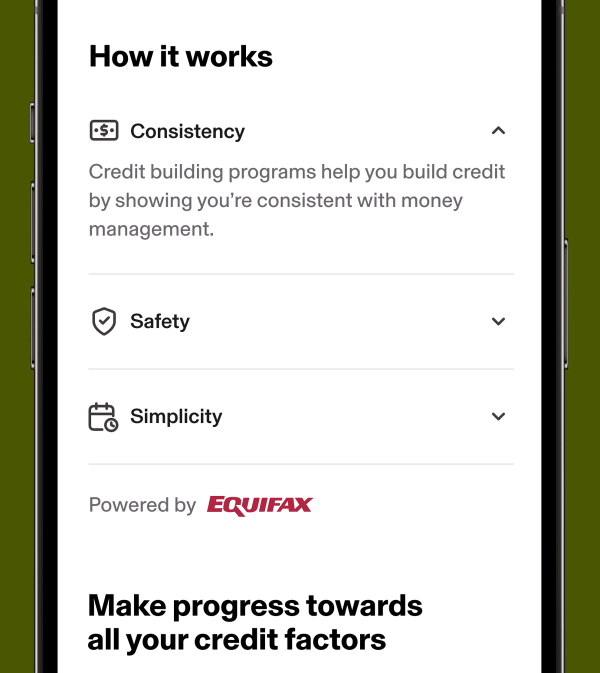

Build credit smartly with KOHO's Credit Building program. Get a dedicated tradeline with no interest. Simply make monthly payments on time to establish credit history that may improve your score. Plus, gain access to our in-house Financial Coach.

Credit builders offer a relatively safer way to build credit as unlike traditional credit products, you don't have to withdraw and use the money to build credit—eliminating the risk of falling into a debt cycle. Instead, consistent monthly payments are reported to credit bureaus, helping you gradually build credit history—without the financial risks that come with traditional credit cards or lenders.

Not at all! A credit builder line of credit is designed to be easy to access. Since there’s no hard credit check, it’s a simple, stress-free way to build your credit history.

They help build your credit history. When you make your payments on time, it shows up as positive payment history - one of the biggest factors in your credit scores.

Credit cards can help, but they often come with high interest rates. KOHO’s Credit Building is a safe and interest-free alternative.

The main difference is that secured lines of credit need collateral—something valuable you own that the lender can take if you don't pay. Unsecured lines don't need collateral, but they usually have higher interest rates and are harder to get.

Not at all! There's no need to withdraw funds. Simply set your utilization rate (we suggest keeping it under 10%) at the start of each billing cycle. However, you'll have access to the funds whenever you need them. They provide a safety net for unexpected situations.

You’ll receive regular updates through KOHO and can monitor your credit report directly in the app.

You know how making payments on time can positively impact your credit? Well the opposite is true too, missing or late payments could hurt your scores. This is why we do not recommend withdrawing from the line of credit. We are invested in your success.

Yes! Thousands of Canadians have used KOHO’s Credit Building to grow their credit histories safely and securely²

KOHO's Credit Building tool retrieves your score directly from our trusted partner Equifax, which is one of the major credit reporting bureaus in Canada. Please note that your scores might vary from what you see on other reporting services. This difference can happen because Canada has two major credit bureaus. Each has its own criteria for scoring your credit. You can reach out to Equifax directly by giving them a call at 1-800-465-7166, or you can also log into your account on Equifax's website (https://www.consumer.equifax.ca/personal/)

The minimum credit scores you need to buy a home depends on which lender you get your mortgage with. In general, you’ll want scores of at least 620 to get a mortgage with a traditional lender (like a bank). This is according to Loans Canada. The better your credit scores, the more likely you are to get a low-interest rate.

You’ll want credit scores in the mid-600s to qualify to buy a car, according to Borrowell. You might qualify for a car loan with lower scores. But, like for buying a home, the higher your credit scores, the better your chances of getting a good car loan rate.

Reach out to our customer support team and write in #coach before writing in your question.

Still have questions?

Can't find the answer you're looking for? Please chat to our friendly team.Visit our FAQs* July 2024. https://www.forbes.com/advisor/ca/credit-cards/best/credit-building/

** Credit scores are based on complex models involving a variety of factors. Consistent on-time payments help improve scores. Missed or late payments may cause credit scores to decrease. Outcomes may vary among users.