Check your free credit score in Canada

Sign up for a KOHO account in less than five minutes, and with a 30-day trial you can check your credit score for free!

Good reasons to check your credit score

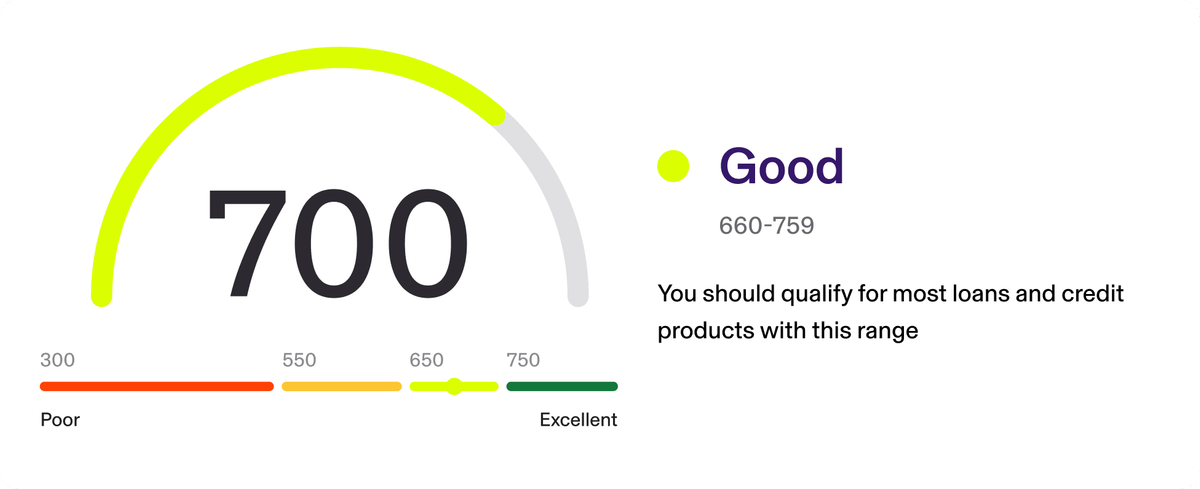

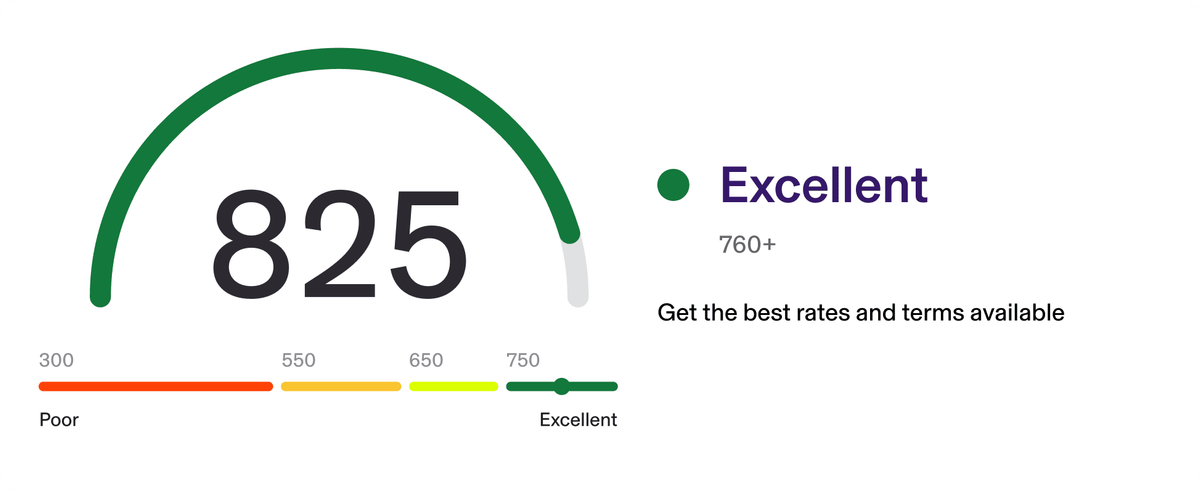

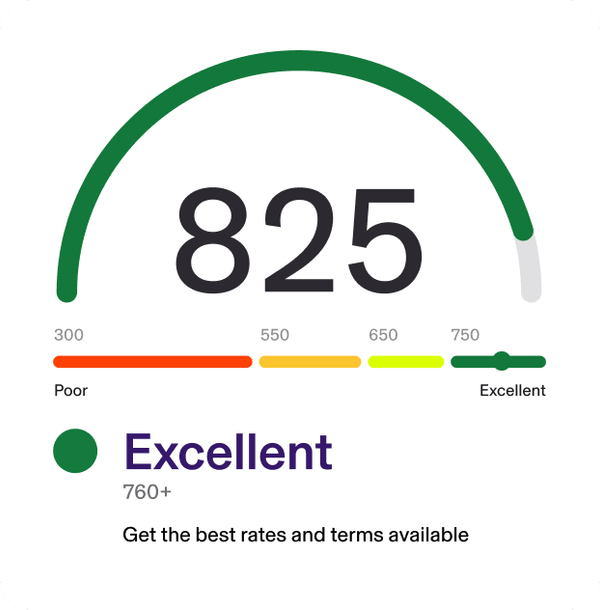

What is a good credit score?

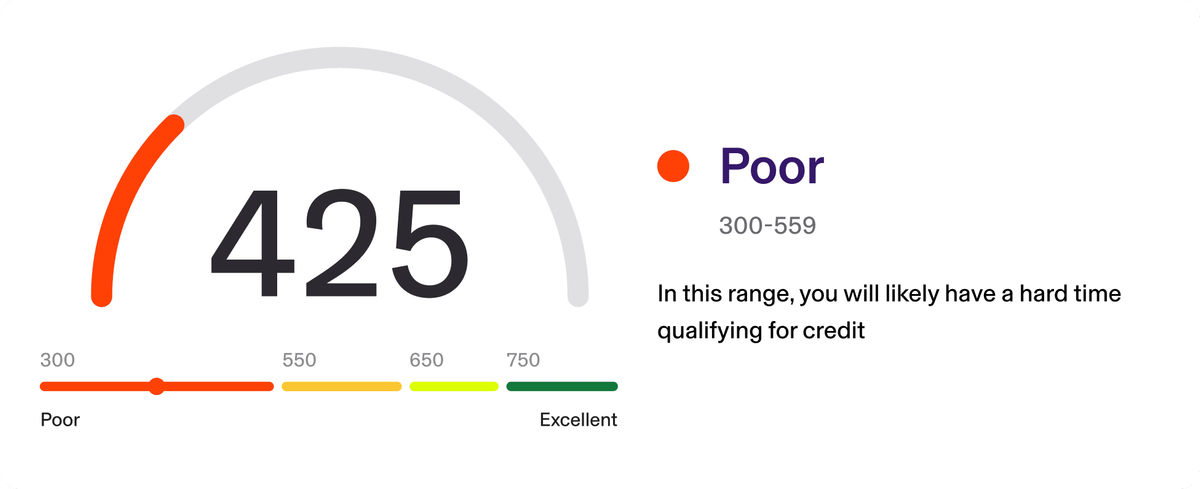

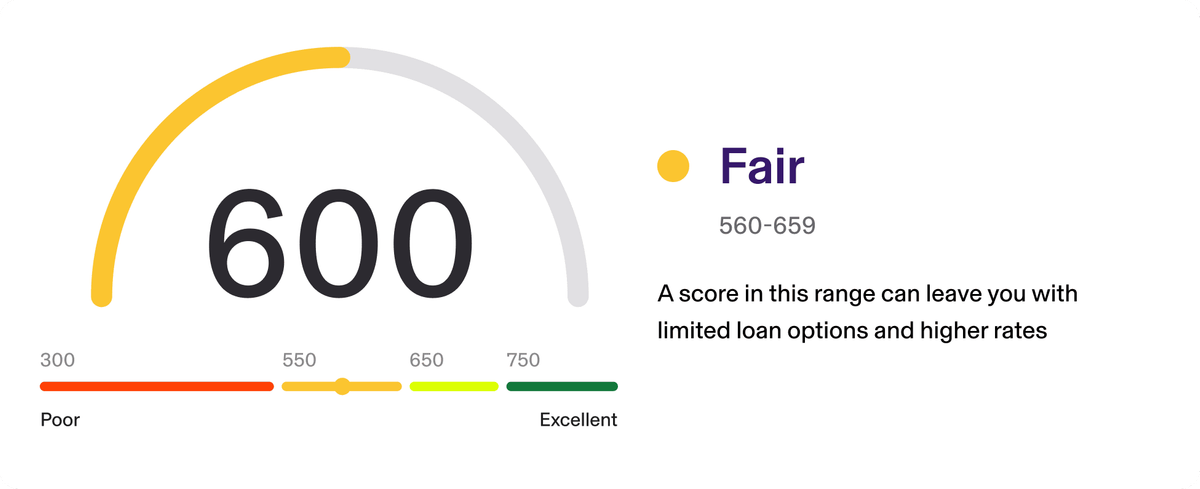

It’s one thing to see your credit score, it’s another to understand what it actually means. Take a look below to understand the different ranges—and keep in mind you can always give it a boost with Credit Building¹.

Get the bigger picture with your credit report

Seeing your score helps, but checking your full credit report can give you a clear look at where you stand. Subscribe to the Everything plan or Credit Building to get your credit report to see:

- Your complete credit history overview

- Full details of your payment history

- All of your account information and balances

- See credit inquiries made in your name

- Think of your credit score as a simple snapshot of where you stand

- Meanwhile, your credit report tells your full financial story

- Together, they give you your complete credit picture—so you know where you need to make progress and where you’re already doing well

The next step? Try credit building

Once you know your credit score, it’s time to give it a boost with KOHO’s Credit Building.

- It’s perfect for anyone looking to start building solid credit history

- New to Canada? It’s a great way to start establishing your credit

- You don’t need a credit card

- The small monthly payment makes it a safe option

- Members using it have seen their credit scores go up by an average of 31+ points in just 4 months*

Get more than just your credit score

All KOHO plans come with a free 30 day trial so you can see if it suits you.

The perfect plan for your needs | Essential Over $100/year in value³$0/mo² | Everything Over $500/year in value³$14.75/mo | |

|---|---|---|---|

Benefits | |||

| Unlimited cash back on groceries, transportation, food & drinks | 1% | 1.5% | 2% |

| Earn interest | 2% | 2.5% | 3.5% |

| Free Credit Score | |||

| Instant e-Transfers | |||

| No Foreign Transaction Fees | - | ||

| Discount on Credit Building | - | 30% | 50% |

| Advanced phone support | - | - |

²Get Essential for free! Learn more

³This is an estimate. Actual savings may vary depending on individual spending habits and service usage

Not sure which one speaks to you? Take our quiz to find the best plan for you.

Find a planThe reviews speak for themselves

We’ve earned the trust of more than 2 million Canadians using KOHO—not to mention their praise.

5 min read

Building a good credit score can feel like aiming for a high score.

FAQS

KOHO works with Equifax, one of the major credit reporting bureaus in Canada. A credit bureau like Equifax basically collects information from creditors on things like your credit history, or your track record of paying off bills, to paint a well-rounded picture of your financial past.

It’s good to keep in mind that you don’t necessarily have just one credit score. Many score providers use different models to work out your score and lenders may not report your data to all credit bureaus, which can cause your score to vary.

Nope, you can check your score as many times as you like as we carry out a soft check, as opposed to a hard check. A soft check is usually carried out for things like loan pre-approvals, or employer credit-checks and won’t affect your overall score, regardless of how many you do it. A hard check usually only happens when you make an application for something like a loan or property rental. These can only be performed with your permission and may also affect your credit score.

We get that finances and credit scores can be stressful enough as they are without the worry of hidden fees, so with KOHO you’ll never need to worry about them. Checking your credit score is always completely free!

It’s good to know your credit score for a lot of reasons, whether thinking about your daily routine or goals you have for down the road.

For major life purchases, like mortgages or car loans, a better credit score can get you better interest rates or financing offers—potentially saving you a lot of money. If you ever want to start your own business, your credit score affects the options you’ll have for loans.

Identity theft is a real problem, and checking your credit score can help protect you from fraud. You can spot unauthorized accounts quickly, credit changes in real-time, and know when to free credit when it’s not in use.

Checking your credit score can also help with simple, day-to-day things. You can see the impact of making on-time payments, and get an overview of the different accounts you hold and how you’re using them. A stronger credit score can help on rental applications, with insurance premiums, and even getting phone or internet plans. Some employers will also check your credit during the application process.

It’s KOHO’s affordable, interest-free way to build or rebuild credit history in Canada. You can either use your own money or a line of credit from us to do it. Head to your KOHO app and click Credit > Register to get going. Or visit https://www.koho.ca/credit-building/ to learn more.

Still have questions?

Can't find the answer you're looking for? Please chat to our friendly team.Visit our FAQs¹Based on users with a starting score of 500 or less and who signed up for credit building in October 2024. Credit Building is not a credit repair tool and does not guarantee an improvement in credit score. Credit scores are based on complex models involving a variety of factors. Consistent on-time payments help improve scores and missed or late payments may cause credit scores to decrease. Outcomes may vary among users.