Instant Approval, Secure, Convenient

A virtual card is a digital version of a payment card.

Instead of a physical piece of plastic, you get:

A card number

Expiry date

CVV

…that live in an app or digital wallet. You use it for online shopping, subscriptions, and mobile payments, just like a regular card—only it’s stored on your phone instead of in your wallet.

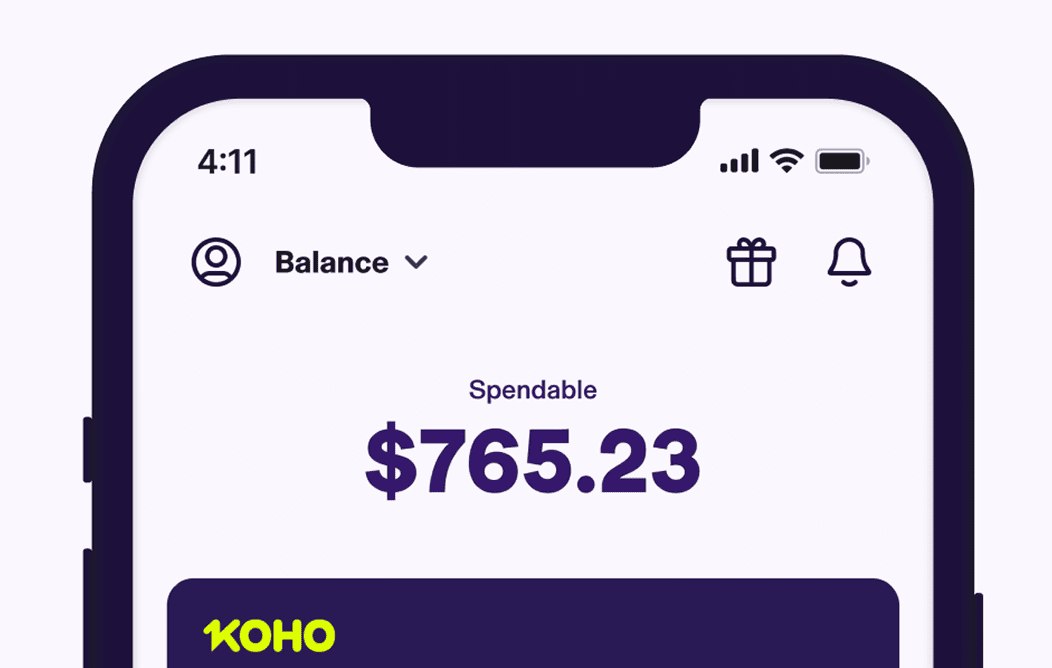

KOHO Essential

If you want something that works smoothly for online and everyday spending, a prepaid and virtual card comes with KOHO Essential Plan:

It has a low monthly plan fee that can be waived when you set up direct deposit or add +$1,000.

Use a prepaid Mastercard® for groceries, bills, subscriptions, and travel.

Get your Virtual Card to start spending online right away, securely.

Grow your savings with a 2% interest savings rate on your entire balance.

Earn 1% cash back on groceries, eating & drinking, and transportation.

You can add Credit Building for $10/month, it's an affordable way to build your credit history

Enjoy unlimited transactions and free e-transfers (never worry about fees when sending money to someone again).

Stay secure while shopping online

How a Virtual Card Works

In practice, a virtual card works like this:

You get your digital card details from your bank or app.

You use those details at checkout for online purchases or subscriptions.

The payment is taken from your linked account or prepaid balance.

Some providers let you change or replace virtual card details if something looks suspicious.

You never have to type your physical card number into every website you use, which can add a layer of convenience and security.

Benefits of Virtual Cards

Security: If a site is compromised, you can often replace or disable the virtual card details without cancelling everything.

Convenience: Your card details are always in your phone/app when you’re shopping online.

Control: Some setups let you create virtual details for specific merchants or uses (like one for recurring subscriptions).

When to Use a Virtual Card

Virtual cards are especially useful for:

Online shopping at new or unfamiliar retailers

Streaming services and subscriptions you might cancel later

In-app purchases and digital services

Situations where you’d rather not share your primary physical card number everywhere

About the author

Quan works as a Junior SEO Specialist, helping websites grow through organic search. He loves the world of finance and investing. When he’s not working, he stays active at the gym, trains Muay Thai, plays soccer, and goes swimming.

Read more about this author