Why save with a KOHO account?

Think you can’t earn more on your balance? Think again. KOHO offers some of the best high interest saving rates in Canada, with up to 4% interest on every dollar. Your money works harder here, earning returns daily and landing in your account every month.

Exceptional Returns

- Earn up to 4% interest on your balance

- Get up to 5% cash back

- Interest calculated daily, paid monthly

Peace of Mind

- Your money is held in trust with CDIC member institutions**

- No NSF fees, and no minimum balance — ever

- Access your money whenever you need it

Quick & Easy Setup

- Sign up easily in less than 5 minutes

- Digital access within minutes

- Automated savings features

Take advantage of competitive interest rates

Earn more with every dollar you save. KOHO's industry-leading rates give you up to 4% interest, putting more money back in your pocket. Choose the plan that works for you and watch your savings grow faster than ever.

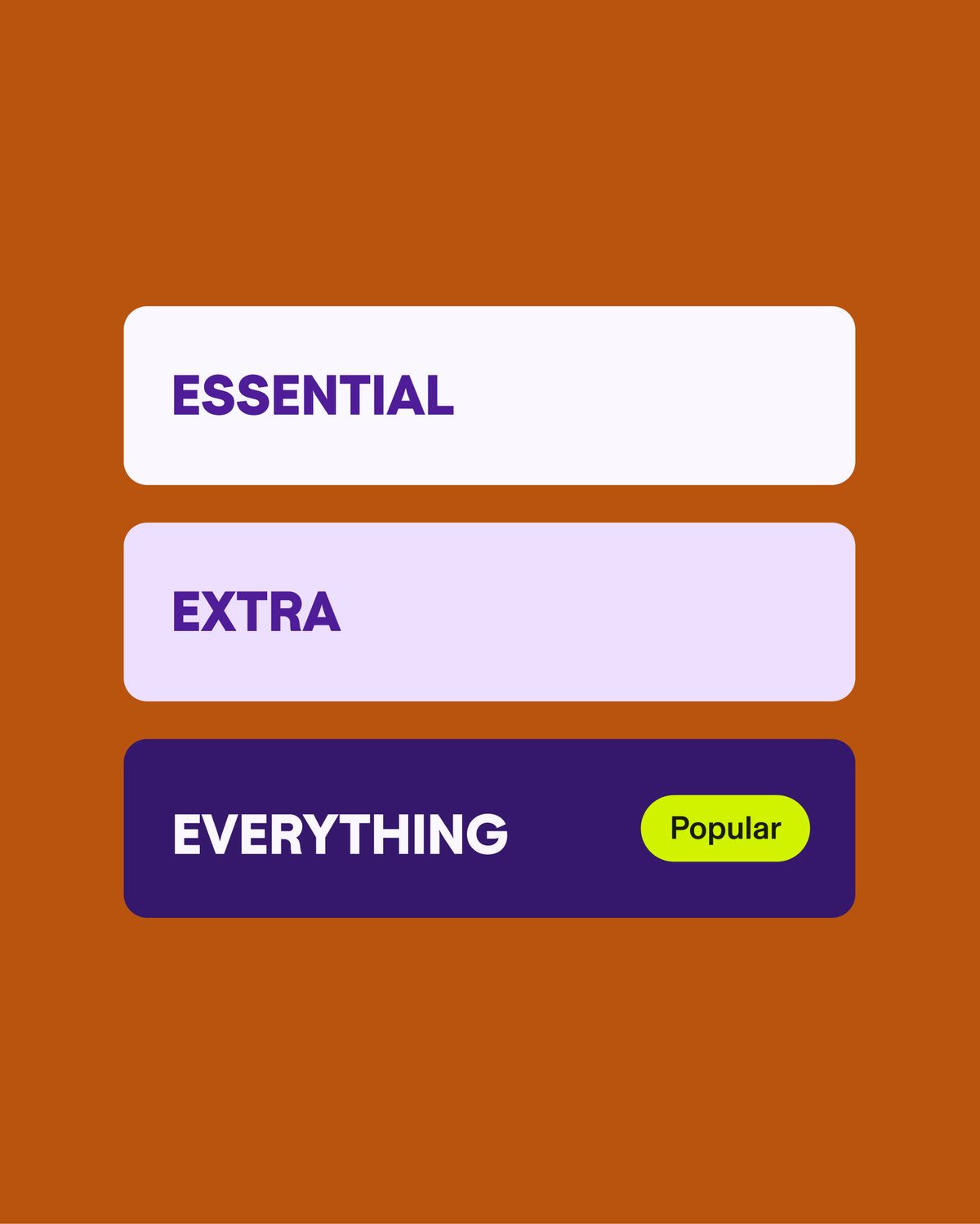

The perfect plan for your needs | |||

|---|---|---|---|

Benefits | |||

| Unlimited cash back on groceries, transportation, food & drinks | 1% | 1.5% | 2% |

| Earn interest | 2.5% | 3% | 4% |

| Free Credit Score | |||

| Instant e-Transfers | |||

| No Foreign Transaction Fees | - | ||

| Discount on Credit Building | - | 30% | 50% |

| Personal Phone Support | - | - |

* Get Essential for free! Learn more

**This is an estimate. Actual savings may vary depending on individual spending habits and service usage

MORE TOOLS TO GET YOU THERE

VAULT

Set aside extra cash you don’t want to spend.

GOALS

Automatically transfer small amounts to your Goal Savings.

ROUNDUPS

Round purchases to the nearest dollar and save the difference.

How to start your high interest savings journey

1. Choose the KOHO plan that works for you

How to start your high interest savings journey

2. Add money to your shiny new account

How to start your high interest savings journey

3. Opt in to Earn Interest in the app and start earning

Don’t just take our word for it

FAQS

Depending on what plan you choose, you’ll earn up to 4% interest on your entire KOHO balance — your Spendable, RoundUps, Savings Goals, all of it. This is an annual rate, which will be calculated daily and paid out monthly to maximize your earnings. Plus, unlike other cards, you can access these earnings at any time!

Rounding up is a great way to save. You can choose the amount you’d like to round each purchase up to and we’ll set that amount aside for you in your KOHO app. Even better? You can cash out your RoundUps whenever you want!

The best high-interest savings account rates in Canada can vary over time due to changes in the prime rate, which is closely tied to the Bank of Canada's overnight rate. When the overnight rate increases, financial institutions can offer more competitive interest rates on high-interest savings accounts as well as on GICs (Guaranteed Investment Certificate) and other savings vehicles.

A High Interest Savings Account (HISA) rewards you with higher interest rates than regular savings accounts. Your money earns interest daily based on your balance, and these earnings are typically paid out monthly. The higher the interest rate, the more your savings can grow over time.

How High Interest Savings Accounts (HISAs) earn interest is relatively straightforward. When you deposit money into a HISA, the bank or credit union uses those funds to make loans to other customers. The interest that these borrowers pay on their loans is, in part, returned to your account as interest earnings. The interest rate on a HISA is typically higher than on a standard savings account, meaning you earn more on your deposits. Interest is generally compounded daily or monthly and paid monthly, although payment frequency can vary by financial institution.

To open a High-Interest Savings Account (HISA), compare banks to find the best rates and check you meet their requirements. Have your ID and proof of address ready, then apply online or at a branch. Once it’s set up, add money to the account and start saving!

HISAs offer high, variable interest rates and allow for flexible withdrawals and deposits. In contrast, GICs lock in your money for a set period, offering a fixed interest rate but penalizing early withdrawals.

The latest from our blog

News, stories and thoughts on money management.

5 min read

Not all savings accounts are the same. Sure, they’re all places you can put aside money to save it. But interest rates can differ considerably.

6 min read

Savings account interest rates have been on the rise in Canada this year, with some of the best accounts offering APYs between 4% and 6%.

8 min read

TFSAs, RRSPs, GICs, HISAs… The list goes on and on. Fortunately, we’re breaking down all the acronyms in this helpful guide.