Get one of Canada's best high interest rates: Up to 3.5% with KOHO

Reach your savings goals faster by earning interest with KOHO. Take advantage of great rates and watch your money work harder for you—helping you make meaningful progress.

Join 2 million+ Canadians

Why save with a KOHO account?

Think you can’t earn more on your balance? Think again. KOHO offers some of the best high interest saving rates in Canada, with up to 3.5% interest on every dollar. Your money works harder here, earning returns daily and landing in your account every month.

Exceptional Returns

- Earn up to 3.5% interest on your balance

- Get up to 5% cash back

- Interest calculated daily, paid monthly

Peace of Mind

- Your money is held in trust with CDIC member institutions²

- No NSF fees, and no minimum balance — ever

- Access your money whenever you need it

Quick & Easy Setup

- Sign up easily in less than 5 minutes

- Digital access within minutes

- Automated savings features

Take advantage of competitive interest rates

KOHO helps your savings go further. Compare and see how.

| KOHO High Interest Savings | Big Banks | |

|---|---|---|

| Interest Rates | 0.5% to 3.5% | 0.010% to 1.5% |

| Promotional Rates | Never | Limited 3-month offer |

| Minimum Balance | None | $1,000 to $500,000 |

| Transaction fees | $0 | $5.00 per transaction |

| Interac e-transfer | Free, Unlimited | $1.00 per e-transfer |

| Account Inactivity fee | $0 | $20.00 to $40.00 |

| Pre-authorized Debit | $0 | $5.00 per pre-authorized debit |

| KOHO High Interest Savings | Big Banks |

|---|---|

| Interest Rates | 0.5% to 3.5% |

| Promotional Rates | Never |

| Minimum Balance | None |

| Transaction fees | $0 |

| Interac e-transfer | Free, Unlimited |

| Account Inactivity fee | $0 |

| Pre-authorized Debit | $0 |

Plan it. Save it. Achieve it.

See how your savings and interest build over time to help reach your goals with the KOHO Savings Calculator.

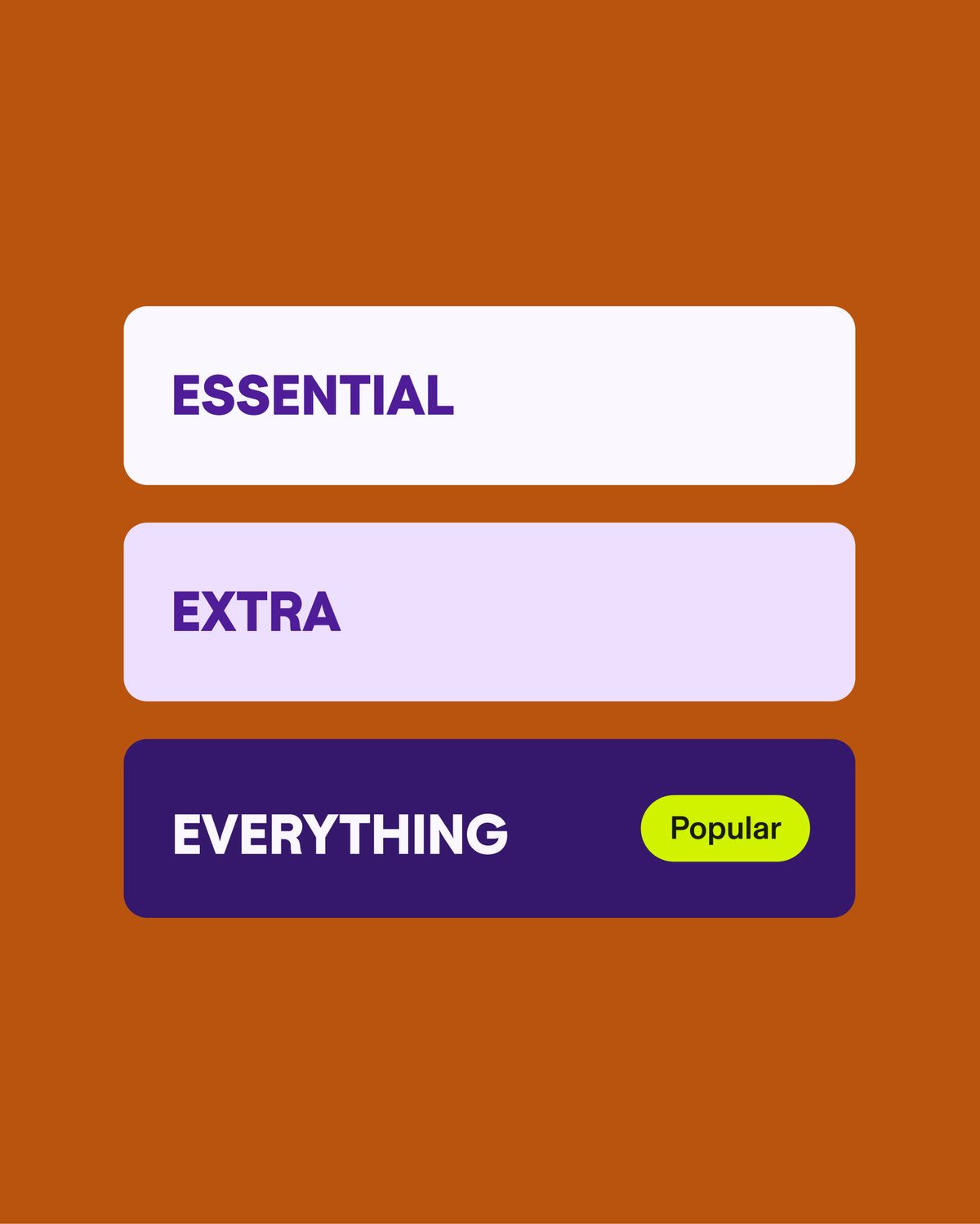

Compare KOHO plans and pick your perfect match

Earn more with every dollar you save. KOHO's industry-leading rates give you up to 3.5% interest, putting more money back in your pocket. Choose the plan that works for you and watch your savings grow faster than ever.

The perfect plan for your needs | Essential Over $100/year in value³$0/mo² | Everything Over $500/year in value³$14.75/mo | |

|---|---|---|---|

Benefits | |||

| Unlimited cash back on groceries, transportation, food & drinks | 1% | 1.5% | 2% |

| Earn interest | 2% | 2.5% | 3.5% |

| Free Credit Score | |||

| Instant e-Transfers | |||

| No Foreign Transaction Fees | - | ||

| Discount on Credit Building | - | 30% | 50% |

| Advanced phone support | - | - |

Not sure which one speaks to you? Take our quiz to find the best plan for you.

Find a planMORE TOOLS TO GET YOU THERE

VAULT

Set aside extra cash you don’t want to spend.

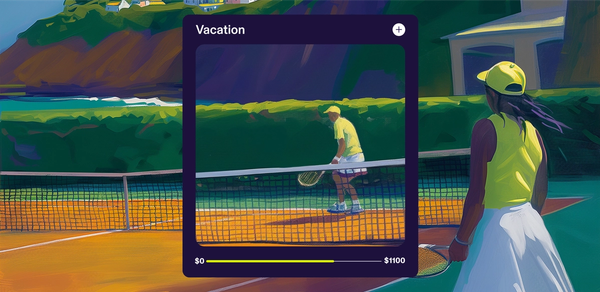

GOALS

Automatically transfer small amounts to your Goal Savings.

ROUNDUPS

Round purchases to the nearest dollar and save the difference.

How to start your high interest savings journey

1. Choose the KOHO plan that works for you

How to start your high interest savings journey

2. Add money to your shiny new account

How to start your high interest savings journey

3. Opt in to Earn Interest in the app and start earning

Don’t just take our word for it

FAQS

Depending on what plan you choose, you’ll earn up to 3.5% interest on your entire KOHO balance — your Spendable, RoundUps, Savings Goals, all of it. This is an annual rate, which will be calculated daily and paid out monthly to maximize your earnings. Plus, unlike other cards, you can access these earnings at any time!

Rounding up is a great way to save. You can choose the amount you’d like to round each purchase up to and we’ll set that amount aside for you in your KOHO app. Even better? You can cash out your RoundUps whenever you want!

The best high-interest savings account rates in Canada can vary over time due to changes in the prime rate, which is closely tied to the Bank of Canada's overnight rate. When the overnight rate increases, financial institutions can offer more competitive interest rates on high-interest savings accounts as well as on GICs (Guaranteed Investment Certificate) and other savings vehicles.

A High Interest Savings Account (HISA) rewards you with higher interest rates than regular savings accounts. Your money earns interest daily based on your balance, and these earnings are typically paid out monthly. The higher the interest rate, the more your savings can grow over time.

How High Interest Savings Accounts (HISAs) earn interest is relatively straightforward. When you deposit money into a HISA, the bank or credit union uses those funds to make loans to other customers. The interest that these borrowers pay on their loans is, in part, returned to your account as interest earnings. The interest rate on a HISA is typically higher than on a standard savings account, meaning you earn more on your deposits. Interest is generally compounded daily or monthly and paid monthly, although payment frequency can vary by financial institution.

To open a High-Interest Savings Account (HISA), compare banks to find the best rates and check you meet their requirements. Have your ID and proof of address ready, then apply online or at a branch. Once it’s set up, add money to the account and start saving!

HISAs offer high, variable interest rates and allow for flexible withdrawals and deposits. In contrast, GICs lock in your money for a set period, offering a fixed interest rate but penalizing early withdrawals.

That depends on where you put your money. With KOHO, your deposits go into your Spendable account which is where you can opt in to Earn Interest on your money—but it’s also where you can make purchases from, get your pay cheque deposited to, and use all of our handy money saving tools. That means it works similarly to both a chequing account and a savings account. It’s up to you how you use it. At other institutions, chequing and savings accounts can be different accounts and require you to move money between them to take advantage of different interest rates and other features.

The interest on your KOHO account is calculated daily and paid out monthly. That means saving more each day can add up over time.

Yes! Simply opt in to Earn Interest with your account and up to $100,000 of money you deposit is eligible for CDIC protection1. That’s the same place that insures many of the big banks in Canada.

Yup! Whether you’re a spender or a saver, KOHO will work for you. For spending, simply add money by setting up direct deposit for your pay cheque, via Interac® e-Transfer, cash deposit, or setting up a recurring payment through another debit card. You can start spending instantly both online and in store. To save with our great interests, simply add money to your account and keep it there—easier said than done, we know. You can also use our helpful savings tools like Vault or Goals to automate savings and keep your hard-earned cash away from spending temptations.

To earn high interest with your KOHO account, all you have to do is opt in to Earn Interest. Then any money you deposit will start earning right away. You can automate savings with Vault or Goals to set money aside that is still earning interest while not directly in your Spendable account.

Not with KOHO. There are no minimum balances, even for the highest interest rate on our Everything plan. Every cent in your account earns interest.

Interest rates at Canadian financial institutions vary over time due to changes in the prime rate, which is closely tied to the Bank of Canada's overnight rate. When the overnight rate increases, financial institutions can choose to offer more competitive interest rates on high-interest savings accounts as well as on GICs (Guaranteed Investment Certificate) and other savings vehicles. KOHO is all about financial empowerment for Canadians, so we like giving you the choice of a higher rate.

Still have questions?

Can't find the answer you're looking for? Please chat to our friendly team.Visit our FAQs¹Actual Interest may vary depending on your KOHO Account plan. Interest Rate is subject to change without prior notice. Interest is per annum calculated daily but paid monthly. Terms and Conditions apply.

²When you opt in to Earn Interest, your funds are placed in trust with one or more CDIC member institutions. Funds held in trust by CDIC member institutions are eligible for CDIC protection of up to $100,000 per beneficiary, per member institution, if the member institution were to fail. For more info on CDIC coverage please check out this link. KOHO Accounts not earning interest are not eligible for CDIC protection.