Make Essential your no fee account

The plan that gets you more from your everyday spending, fee free¹.

No-Fee Account, All the Essentials

Get Essential

Unlock the Essential plan with no fees by setting up direct deposit or adding $1,000.

Grow your savings with a better rate on your entire balance.

Earn great 1% cash back on groceries, eating & drinking, transportation.

Send money to 190+ countries quickly and securely with the best exchange rates and no hidden markups or other-worldly fees.

How to get Essential for $0—plus $100 in value?

At KOHO, we believe in rewarding you for making smart financial choices. That's why we've introduced a straightforward way for you to enjoy all the benefits of Essential for $0/month—delivering over $100/year in value.

Choose either of these easy options to activate Essential Unlock

Set up Direct Deposit

Simply set up a recurring direct deposit for your paycheque or government benefits. We process payments as soon as we get them. How fast is your bank?

Add $1,000+ Each Month

Put a total of $1,000 or more into your KOHO account each month. How it gets there is up to you—cash deposits, e-Transfers and transfers from other accounts all count. The money doesn’t have to stay there, so spend like usual.

More features for more savings

Instant Card Access

Get your virtual prepaid Mastercard instantly, plus receive a physical card

$250 Cash Advance

Access up to $250 cash advance with Cover bundle

Free credit score

Monitor your credit score from Equifax at no cost

Rent Reporting

Build your credit history by by paying your rent with your KOHO account

Free e-Transfers

Send money with zero fees

Up to 50% Cash Back

Earn additional cash back at over 1000+ merchant partners

Unlimited transactions

Make as many transactions as you need with no limits

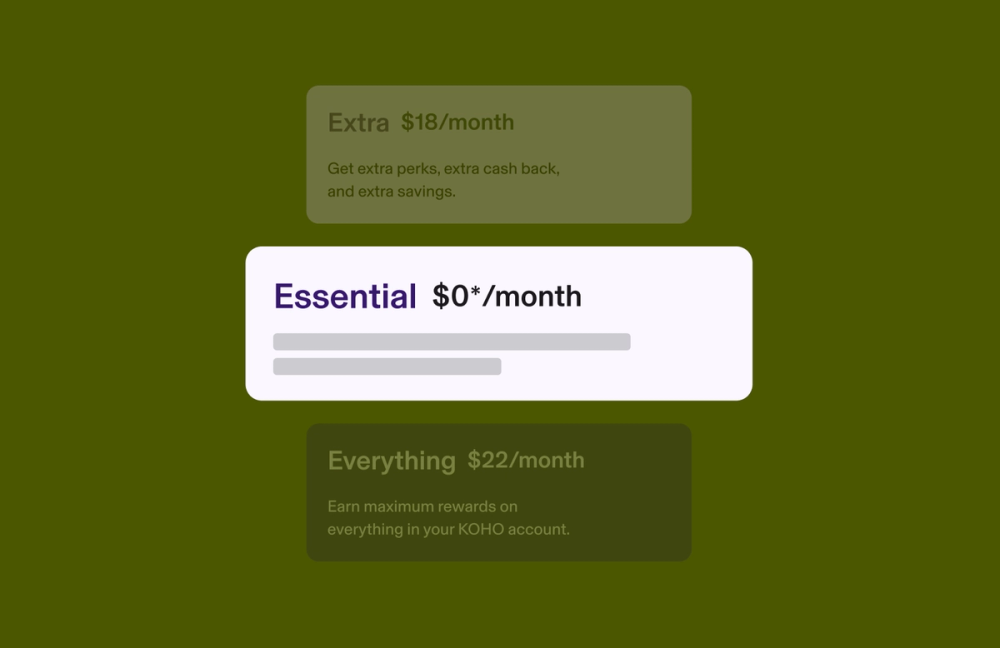

Pick a plan and try it at no cost

All KOHO plans come with a free 30 day trial so you can see if it suits you.

The perfect plan for your needs | Essential Over $100/year in value³$0/mo² | Everything Over $500/year in value³$14.75/mo | |

|---|---|---|---|

Benefits | |||

| Unlimited cash back on groceries, transportation, food & drinks | 1% | 1.5% | 2% |

| Earn interest | 2% | 2.5% | 3.5% |

| Free Credit Score | |||

| Instant e-Transfers | |||

| No Foreign Transaction Fees | - | ||

| Discount on Credit Building | - | 30% | 50% |

| Advanced phone support | - | - |

Not sure which one speaks to you? Take our quiz to find the best plan for you.

Find a planThe reviews speak for themselves

We’ve earned the trust of more than 2 million Canadians using KOHO—not to mention their praise.

How KOHO compares

See how the Essential plan compares to accounts with traditional banks.

| KOHO Essential | Traditional No Fee Bank Accounts | |

|---|---|---|

| e-Transfers | Free | None |

| Unlimited Transactions | Free | No |

| Credit Score | Yes | Varies |

| Interest Rate | 2% | None |

| Minimum Opening Deposit | $0 | Up to $25 |

| Maintain Daily Balance | $0 | Up to $6,000 |

| KOHO Essential | Traditional No Fee Bank Accounts |

|---|---|

| e-Transfers | Free |

| Unlimited Transactions | Free |

| Credit Score | Yes |

| Interest Rate | 2% |

| Minimum Opening Deposit | $0 |

| Maintain Daily Balance | $0 |

All the essentials.

None of the fees¹.

Open your account and start saving in just 5 minutes.

FAQS

Think of a prepaid card as a hybrid of a debit card and a credit card. It combines all the benefits of both into one, easy-to-use card.

A prepaid card is essentially a card that you load with money before using it for everyday purchases. They work just like regular debit cards, except you don't need a bank account to use them. With prepaid cards, you have more control over your spending and you can't spend more money than what you load onto the card.

You can withdraw cash from an ATM using your physical KOHO card. Look for ATMs on the "Cirrus" network as they'll support withdrawals using a Mastercard.

Important:

- You may be charged a $2-3 out-of-network fee to use an ATM (KOHO doesn't own any ATMs for free withdrawals).

- We do have withdrawal limits in place. You can review your account limits directly in-app by tapping on the profile icon (top left) > Account velocity limits.

- Get one free withdrawal at ATMs outside Canada each month with an Extra or Everything plan. International ATM fees are usually at least $2-3 a pop. Reach out to our support team for a reimbursement to your account!

You can earn cash back on everyday essentials like groceries, eating & dining, and transportation. Just use your KOHO card like usual. You can earn additional cash back on top of what you earn with your KOHO plan when you shop with our merchant partners. Learn more on our cash back page.

Take a look below to understand the different ranges for your credit score—and keep in mind you can always give your credit history a boost with Credit Building.

Credit Score Ranges:

Excellent: 750-900

Good: 650-749

Fair: 550-649

Poor: 300-549

The Credit Building feature is available as an add-on across all plans. You simply take out a line of credit with KOHO and on time repayments build your credit history which can build your credit score.

Opening an online account with KOHO is simple, and only takes 5 minutes.

To get started, you'll need:

- To be a Canadian resident

- To be at least 18 years old (19 in some provinces)

- A Government-issued ID (like a driver's license or passport)

- A phone number and email address

That's it. No minimum deposit or credit check. Quick and easy.

Of course! KOHO is all about giving you options to find the plan that’s right for you. Here’s how you can switch:

From the KOHO app:

- In-app > click on My Plan > scroll down and select Change my plan.

- On the Manage Plan page, select Change and choose your preferred KOHO plan.

From the web portal:

- Login via web.koho.ca/login and select My Plan > Manage my plan.

- On the Manage my plan page, choose your preferred KOHO plan and select Change my plan.

Once you sign up for Essential you’ll need to opt in on the Interest page in-app to start earning on everything in your spending and savings account. 2% is an annual rate that’s calculated daily and paid out monthly to maximize your earnings. Once you choose to opt in, you’ll start earning right away.

Still have questions?

Can't find the answer you're looking for? Please chat to our friendly team.Visit our FAQs¹Get Essential for free! Learn more

²This is an estimate. Actual savings may vary depending on individual spending habits and service usage