Send money to 190+ countries. Best Exchange Rates.

The best way to send money internationally are through specialized money transfer services like KOHO, Wise, OFX, Xoom, MoneyGram, and Western Union. These providers often offer lower fees and better exchange rates than traditional banks.

Banks might seem like the go-to option for sending money abroad, but they're actually the priciest choice. According to The World Bank's June 2024 Remittance Prices Worldwide Quarterly report, banks charge an average of 13.40% of the transfer amount.

That's a big chunk of your hard-earned cash!

1. KOHO

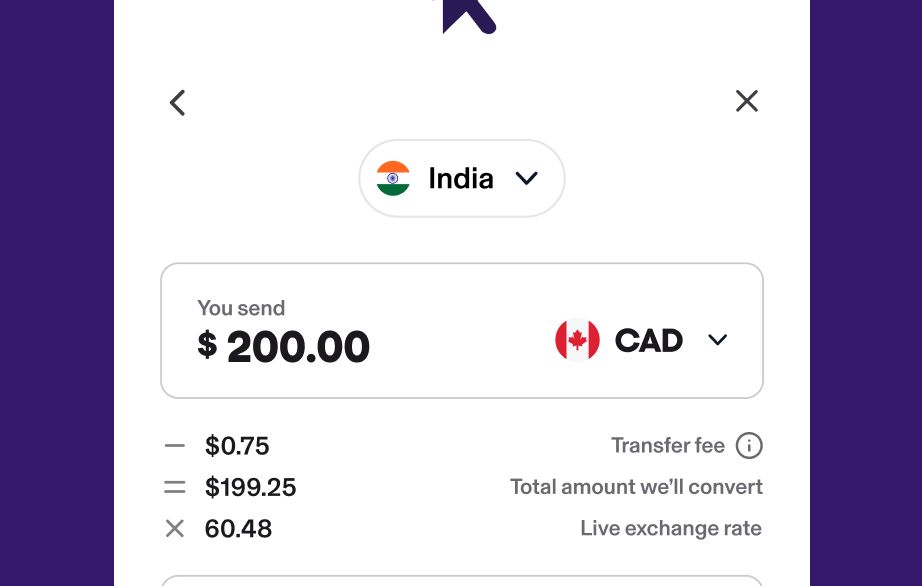

Sending money across borders can be expensive and full of surprises. With KOHO, International Money Transfer is always fast and secure with no hidden markups or other-worldly fees.

Coverage: We cover over 190+ countries

Cost: We use the live exchange rate for every International Money Transfer–that’s the best rate around for most countries.

Speed: Transfers to most countries are processed within 30 minutes but could take longer.

Transfer Limits: Minimum transfer is $10 and daily maximum is $5000 (up to $15000 monthly)*

Whether you're helping family back home, paying for services abroad, or sending money to friends–we've made it simple, affordable and fast.

*Account specific limits and restrictions may apply.

Send Money Right From The KOHO App.

2. Wise

Coverage: You can send money to over 70 countries from the US

Cost: Usually under 1% of the transfer amount when you use a bank account

Speed: Transfers can be quick, sometimes arriving the same day

Transfer Limits: You can send up to $1 million per transfer using ACH, or $6 million from your Wise account balance

3. OFX

Coverage: Covers more than 170 countries

Cost: Exchange rate markups are typically between 1.35% and 4.50%

Speed: Transfers usually take 1-3 business days to arrive

Transfer Limits: The sending minimum per transfer is $150, and there’s no maximum.

3. XOOM

Coverage: Serving nearly 160 countries and territories

Cost: Exchange rate markups can be over 3%

Speed: Transfers can take minutes, but could take up to a few days depending on banking hours and timezones

Transfer Limits: Sending limits vary, but daily transfers are capped at $50,000

4. Moneygram

Coverage: They cover over 200 countries and territories

Cost: Markups vary depending on where you send the money, and they can surpass 2%

Speed: Can arrive in a day

Transfer Limits: Maxes out at $5,000 per online transfer for certain countries

Some tips to remember

Compare exchange rates: Look for providers with the lowest markup compared to the rates you see.

Check total costs: Don't just look at fees, factor in the exchange rate too.

Avoid credit cards: They often come with higher fees and extra costs.

No Hidden Fees.

Start saving on your international transfers

Sending money internationally doesn't have to cost an arm and a leg. By choosing the right provider and method, you can keep more of your money where it belongs - in your pocket (or your recipient's).

Remember to shop around, compare total costs, and choose the option that best fits your needs. Happy transferring!

About the author

Quan works as a Junior SEO Specialist, helping websites grow through organic search. He loves the world of finance and investing. When he’s not working, he stays active at the gym, trains Muay Thai, plays soccer, and goes swimming.

Read more about this author