What is KOHO?

KOHO is a no-fee spending and savings account here to simplify your personal finances.

It’s a bit like a spending account, with the perks of a credit card. Think of KOHO as a collection of features designed to help you reach your goals faster and spend your money on things you like, rather than things that you don’t, like credit card interest or hidden fees.

The key difference is that unlike a traditional credit card, it’s already your money—there’s no interest to pay, and the funds on your card are, well... all yours. Plus, unlike pretty much everyone with just a bank-issued credit card.

The long and short of it is that KOHO makes it easier (dare we say even fun) to manage your spending and savings habits.

The features of KOHO

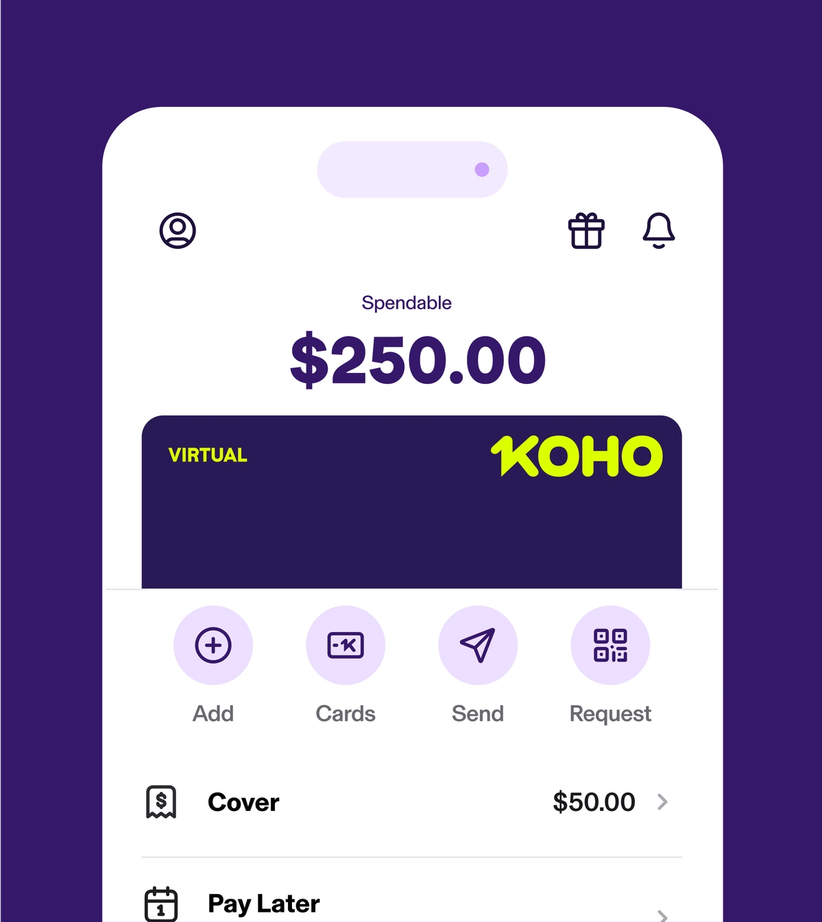

People use KOHO as their financial helper with a spending account, interest-free cash advance, line of credit, high interest savings, virtual card, extra cash back, and handy app all in one place.

The basic flow is simple:

Load money to your account through e-Transfer or direct deposit

Use your prepaid mastercard for purchases and earn cash back on groceries, eating & drinking, and transportation

Check the app to track spending habits and build better saving routines

Get an Instant, Interest-Free Cash Advance.

What else does KOHO offer?

KOHO has more than just the basics. You can earn up to 4% interest on your money.*

There's also a credit builder loan, which helps build your credit history. Just subscribe in the app and make sure you've got the fee covered for the next six months. We report your payments to an official credit bureau on your behalf so you don't have to worry about it.

When you sign up for a KOHO account, you'll receive a physical and virtual card. You can use your virtual card anywhere Mastercard is accepted online, or when you add it to your Google, Apple, or Samsung Pay you can tap it in person anywhere that accepts contactless payments.

And when you tell friends about us, you both get $20. Or two free months of Everything plan which means more cash back, interest, and more money in your account.

*Interest rates are per year, calculated daily, paid monthly, and can change at any time without notice.

Earn Interest. Get Cash Back. Build Credit.

How do most people use KOHO?

People usually start with KOHO for fun spending - loading money that's left after paying bills and saving. Think of it as your guilt-free spending cash. Some money experts suggest about 30% of your paycheque should go toward things like food, fun, and social stuff. But everyone's different, so your numbers might not match this exactly.

KOHO also makes saving pretty simple. Our data shows users save about 7% of the money they load (through RoundUps and Savings Goals), compared to the average 2% millennials typically save.

Over time, more people are using KOHO as their main account - getting their paycheque deposited directly and paying bills straight from the app. Who wants to pay for fees or interest?

Where does KOHO put my money?

Your money sits with Peoples Trust, a federally regulated financial institution. If anything happened to KOHO, your money would stay safe and you could still access it through Peoples Trust.

What's different about KOHO vs. a debit account?

The biggest difference is we're digital-first, no branches or lineups. We keep costs low and focus on helping you feel good about your money decisions.

You also get cash back on purchases (1% on everything with an Essential KOHO account, and even more on major categories with KOHO Extra).

We've partnered with brands like Crocs, Sephora, Walmart, and Well.ca for even more cash back.

And our app is actually good. Banks might update their apps monthly, but we make improvements every couple of weeks.

Earn extra cash back beyond your KOHO plan.

Did you know that you can get the Essential plan for free?

Unlock our Essential plan at no cost when you set up Direct Deposit or when you deposit $1000 each month (spend it however you like—no minimum balance required).

Sign up for an Essential Account.

What makes the app worth using?

We update it constantly based on research to help you manage your money better.

Join over 2 million Canadians who trust KOHO as the ultimate way to spend and save—no hidden fees, no fine print, no catch.

With a prepaid Mastercard and innovative tools, we provide our users with the ability to earn, spend, borrow, build credit, and budget—all in one convenient app.

Do I still need a regular bank account?

Probably yes. But if you set up direct deposit for your paycheque and never write paper cheques, you could use KOHO for most banking needs.

You can pay all your bills from the KOHO app. This includes utilities, phone & internet, credit cards, subscriptions. Did we mention that you can send unlimited free e-Transfers.

If you need to write cheques or only want to deposit part of your paycheque to KOHO, you'll still need a bank account.

Paying Bills Made Easy.

Why do 2+ million customers love KOHO?

We give Canadians the tools to make their money grow, and make life better, every single day. KOHO members get up to 6.5% cash back, earn up to 4% interest, build credit, and easily borrow money.

Plus, you can get exclusive perks for day-to-day life stuff like rent and travel. Simply put, KOHO is one place for your money and your life.

» See why Canadians love KOHO.

What's next for KOHO?

Thanks for asking! Our future plans are public, and we love hearing what you want. Our team uses your suggestions to plan our next steps. KOHO exists to help you feel good about your money.

We're building KOHO for the people who want a better financial life. Every Canadian who joins us and speaks up helps create a better KOHO.

About the author

Silvi Woods is a financial planner at Wealthsimple and holds her CFA and CFP designations. Prior to Wealthsimple, she worked as an Investment Analyst for one of Canada’s largest equity mutual funds and as a Financial Planner at KOHO.

Read more about this author