Do you ever check your bank account balance and wonder where all of your money went? Checking your bank statement regularly can help you keep closer tabs on your spending habits, while keeping an eye out for errors.

Reviewing your bank statement may not seem like the most fun task — and you may even think it’s unnecessary. But mistakes do happen, so ensuring you know every dollar going in and out of your account is crucial.

What is a bank statement and how does it work?

A bank statement is a log of all of the financial transactions made from your bank account. Most bank statements are issued monthly, but some might be sent quarterly instead. Your bank statement will usually include a record for all of the bank accounts you have under one bank — chequing, savings, guaranteed interest certificates, and more. You should receive a bank statement from every financial institution you have a bank account with.

Your bank statement will break down how much money went into your account in a given statement period, and itemize all of the withdrawals and transactions that came out of your account. You’ll also be able to see any interest you accrued.

It’s similar to a credit card statement, except it details your bank transactions, rather than your credit card usage.

What is my statement period?

Your statement period is the amount of time reflected on your bank account statement. Most banks have a statement period of one month. However, it’s not uncommon for certain financial institutions to have a statement period of three months, or one quarter.

What information is on my bank statement?

Your bank statement will contain a variety of activity, including:

Personal information

Near the top of your bank statement, you’ll find personal information about the account owner. This usually includes your name, mailing address, and phone number. If you recently moved or married and changed your name, it’s a good idea to check your bank statement to make sure it reflects the correct information.

Account details

Also usually located near the top of your bank statement, you’ll find your bank account information. This typically includes your bank or credit union�’s full name, address, and account number. It may sometimes also include your bank’s routing number.

Your starting balance

This details how much money was in your account at the start of the statement period. If the number looks off, you should check your previous bank statement to make sure there was no activity you didn’t recognize.

Deposits

In your transaction activity, you’ll be able to see any money that came into your account during a specific statement period. This will include any direct deposits, paychecks, cheques, transfers into your account, or bucks you’ve deposited at your bank or through an ATM.

Withdrawals

The other half of your transaction activity will show money that was moved out of your bank account. This could be money taken out from the bank directly, outgoing cheques, money withdrawn from an ATM, credit card bill payments, money transferred to another account, money moved directly into savings, electronic bill payments, and debit transactions.

Fees

Here you’ll find any fees your bank or credit union charged you during a specific statement period. These fees could include monthly maintenance fees, transaction fees, debit fees, ATM fees, non-sufficient funds fees, or overdraft fees. If you notice you’re being charged a high amount in fees, you might consider switching to a free online bank account or finding a bank with cash advance.

Interest earnings

If your bank account earns interest, the amount you accrued will be listed on this log. You should see your interest rate, as well. It’s a good idea to keep an eye on this number in case your interest rate drops. If it does, you might consider switching to a high interest savings account with a more competitive rate.

Your ending balance

Lastly, you’ll see your bank account’s closing balance. This reflects how much money is in your account at the end of all of the activity in the given statement period. It may be at the top or very bottom of your statement.

How do I view my bank statements?

If you can’t remember the last time you’ve seen your bank statement, you’ll want to find out how your bank is sending you copies of your financial information. There are typically three ways you can view your statement.

By post

Most banks and credit unions mail you paper bank statements at the end of each statement period. Though this is standard practice, some online banks may require you to opt in to receive your bank statement by mail.

You can also opt out of receiving bank statements in the mail. You can usually change this in your online account settings, but you can also call your bank or visit them in person to adjust your bank statement delivery preferences.

Online

There are two ways to view your bank statement online. First, if you opted in to receive electronic statements or eStatements, your bank may email them to you monthly. You may receive a PDF copy or be prompted to log into your account to view the full record.

You can also find a log of your bank statements when you sign in to your online bank account. Each bank keeps your bank statement log in a separate place, but it’s generally easy to find. There you can view your most current statement, as well as past bank statements. This can be helpful if you’re trying to track down an older transaction or deposit.

By app

Most financial institutions also offer a mobile banking app to view your account information. Some banks will let you view and download your account statements via mobile app, while others might require you to log into your account on an internet browser.

Are bank account statements important?

It’s a smart idea to review your bank statements regularly to make sure there aren’t any suspicious transactions or errors. For example, you might notice that your bank statement’s interest rate doesn’t match your online account’s interest rate. In that case, you’ll want to reach out to your bank and have a copy of the bank statement ready.

There’s also the possibility that fraudulent transactions are made from your account by hackers who may have obtained your bank information. If you notice a suspicious transaction, contact your bank or credit union immediately to let them know your account may have been compromised. You may need to review multiple bank statements to make sure there are no additional fraudulent charges.0

Occasionally transactions go through twice. If this happens, you could find yourself paying for a bill, like a credit card payment, or purchase more than once. Reviewing your bank statement once a month can help you confirm that every bank transaction was valid. And it can also help your balance your chequebook.

But there’s another hidden benefit to reviewing your bank statements frequently. You’ll be more aware of how you’re spending your money. If you think there’s no wiggle room in your budget for an extra expense or to put more money toward savings, read your bank statement to make sure you know where your money is going.

You might find you’re paying for subscriptions you no longer use or spending more bucks at restaurants than you realized. Keeping a close eye on your transactions can help you curb overspending that you may have been unaware of.

How long should you keep bank statements?

If you receive a physical bank statement, you don’t have to hold on to your copy — as long as you can access a digital bank statement online. But if you’re someone who prefers to have physical documents at hand, you should hold onto your bank statements for at least a calendar year, or until you file that year’s tax return. Some experts recommend holding on to bank statements for up to three years, just to be safe.

Ultimately, it’s your preference if you’d rather keep a paper bank statement or digital copy. Just make sure you know how to access the information on your bank statement if you need it.

Are bank statements free?

It depends. Some banks charge for paper bank statements and others might levy a small fee for statements, regardless of how they’re sent.

Some banks may reward you for opting for electronic bank statements, since you’re saving them money on postage and printing costs. They might offer you a higher interest rate on your savings or waive or lower your monthly bank fee.

Other reasons why you may need your bank statements

If you’re applying for financing — like a mortgage or a loan — the lender may want to see a record of your finances. Lenders generally want a copy of your most recent bank statement (sometimes multiple statements) to get a better idea of how you manage your money. They may require anywhere from one month to three months of bank statements, depending on the type of loan you’re applying for. Your bank statement is also essential if you need proof of income but are a freelancer with irregular earnings.

Do all bank accounts offer bank statements?

Yes, if you hold a bank account at any Canadian bank, you should receive a bank statement monthly or quarterly from them. If you have a bank account you’ve never received a bank statement for, reach out to the financial institution directly. You can also search in your account settings to see if you can pull a copy of your bank statement there.

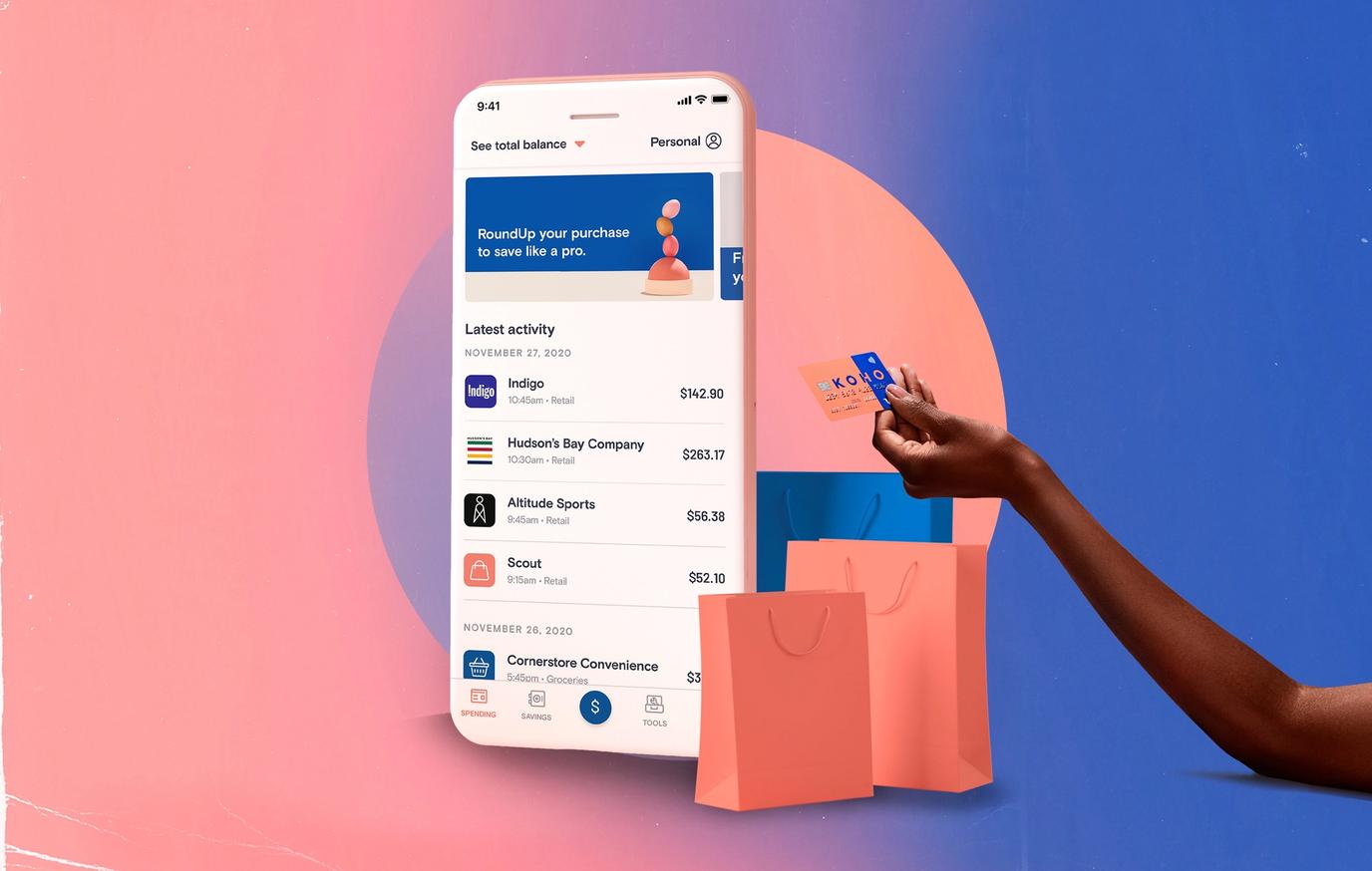

Looking for a new bank account? Check out KOHO’s savings account

If you’re in the market for a new bank account, KOHO offers a combined spending and savings account that lets you earn up to 5% APY to grow your savings a little faster. For a low monthly price, you get overdraft protection and the ability to build your credit with KOHO.

KOHO offers free credit report access and can help you boost your credit score with lines of credit. You’ll also receive a virtual credit card to help protect your financial information when you’re paying online.

Learn more at https://www.koho.ca/.

About the author

Courtney is a professional writer, editor and financial literacy enthusiast. You can find her writing on CNET, Investopedia, The Motley Fool, Yahoo Finance, MSN and The Balance. She spends her free time exploring different cities across the globe or enjoy some downtime with her two cats and one dog.

Read more about this author