Back

The Ultimate Budget Templates: 5 Ways to Master Your 2024 Budget

7 min read

Written By

Courtney Johnston

Rounding it up

A good budget should help you achieve two things: prevent you from going into the red and get you closer to your financial goals.

There are different ways to create a budget. If you like to be super hands-on, the try tracking your expenses in real-time and updating your budget on a daily or weekly basis.

If you don’t want to track every penny, do some planning in advance by splitting your paycheque into buckets for bills, spending, and saving.

After creating your budget, it’s time to build the spending habits that will help you stick to it. Be realistic, and don’t forget to give yourself some wiggle room.

Want to start tracking your spending a little more closely? Creating a budget is one of the best ways to get on top of your spending habits so you can start tackling savings goals. And with today’s digital tools, making a budget is easier than ever.

There are a number of different ways to go about building a budget — from budgeting apps to Google sheet or excel templates. In this guide, we’ll walk you through the best budget templates to help you finally achieve your financial goals.

What are monthly budget templates?

A monthly budget template is an Excel spreadsheet or Google sheet that helps you keep track of all of the money going in and out of your bank account. There are different ways to monitor your spending, and each budgeting template works a little differently.

How a budget template can help

Some budgeting templates use the zero-budgeting model, where every dollar in your budget is assigned to the goal. But if that’s too rigid for you, you might consider trying the 50/30/20 savings rule, where 50% of your income goes toward your essential expenses, 30% toward non-essentials, and 20% toward savings. Some people even like to use prepaid cards to budget better and prevent overspending.

There’s no one-size-fits-all budgeting plan, you just have to find the approach that works best for you.

5 budget templates to get you started

If you're ready to try out budgeting, here are four free budgeting templates that can help you track expenses, view spending patterns, monitor your cash flow, and save money.

KOHO's Budget Planner Template

Introducing KOHO's Budgeting Planner Template - a comprehensive tool designed to empower users to take control of their finances effortlessly. Our planner simplifies the budgeting process, making it easier than ever to manage your money effectively.

This planner encompasses key categories essential for sound financial management:

After-Tax Income: Input your monthly income after deductions to establish a clear understanding of your financial resources.

Monthly Expenses: Categorize and track your expenses, ensuring transparency and enabling informed decision-making.

Personal Spending: Allocate funds for personal expenditures, whether it's dining out, entertainment, or leisure activities, while maintaining fiscal discipline.

Cash Left Over: Gauge your surplus funds after accounting for expenses, providing insight into your financial health and potential savings.

Utilizing our budgeting planner offers several distinct advantages:

Streamlined Organization: KOHO's template streamlines the budgeting process, eliminating the hassle of manual calculations and paperwork, allowing you to focus on your financial goals.

Holistic Financial Management: By incorporating crucial categories like after-tax income and personal spending, our planner offers a comprehensive approach to financial management, ensuring no aspect of your finances goes unnoticed.

Goal Achievement: Set clear financial objectives and track your progress effortlessly with our planner, empowering you to achieve your goals, whether it's saving for a vacation, purchasing a home, or paying off debt faster.

Debt Repayment Acceleration: With a clear overview of your finances, you can strategize and allocate resources effectively towards debt repayment, accelerating your journey towards financial freedom.

In essence, KOHO's Budgeting Planner Template serves as your trusted companion on the path to financial success, providing the tools and insights necessary to make informed decisions, achieve your aspirations, and ultimately, attain financial stability and security.

Try a Microsoft Office Excel template

Microsoft Office Excel is one of the top platforms for building spreadsheets. It’s easy to use and best of all, comes with a variety of preloaded templates to make creating a custom spreadsheet fast and easy.

It’s also easy to build a budget with Excel. This program has a large selection of budget templates to choose from, with different budgeting approaches, colour schemes, and processes. You can choose a bare-bones personal budget template that focuses on the basics (money in vs. money out) or get more granular with a budget overview complete with charts and savings goals to work toward.

You can check out all of the free Microsoft Excel templates available online here.

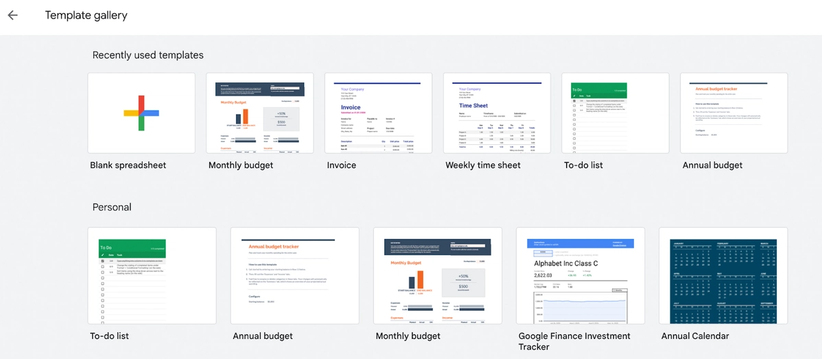

Craft a Google Sheets budgeting template

A rival to Excel, Google Sheets is another easy-to-use spreadsheet builder that you can access with a Google account. Sheets work similarly to Excel but can be a bit easier to learn if you’re not familiar with crafting spreadsheets.

Google Sheets also offers different preloaded templates, including a few large budget templates. To access them, go to Google Sheets, click on File > New > From Template Gallery, and then search for budget templates in the Template Gallery.

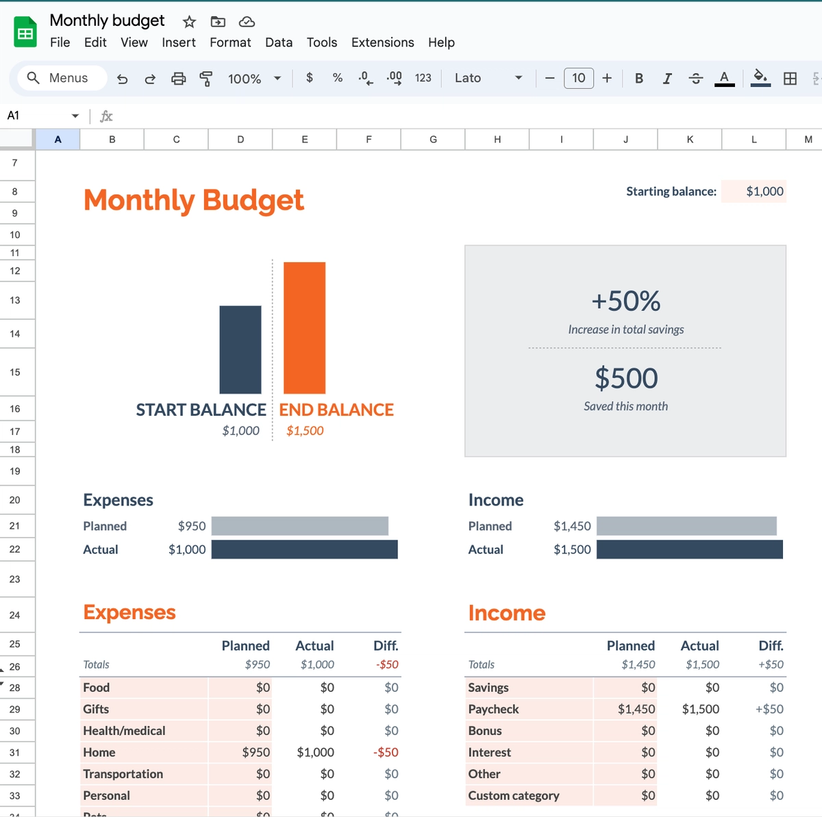

If you want to start with a monthly budget, select the Monthly Budget template. This will then create a new Google sheet using the personal budget template’s preformatted settings. It should look something like this.

To use this template, you’ll need to enter in your income, expenses, and starting balance. You can itemize your expenses or group them by category, whichever you prefer.

There are also a variety of free monthly budget templates available for Google Sheets online that other financial experts and educators have built. A quick Google search will allow you to browse through your different options.

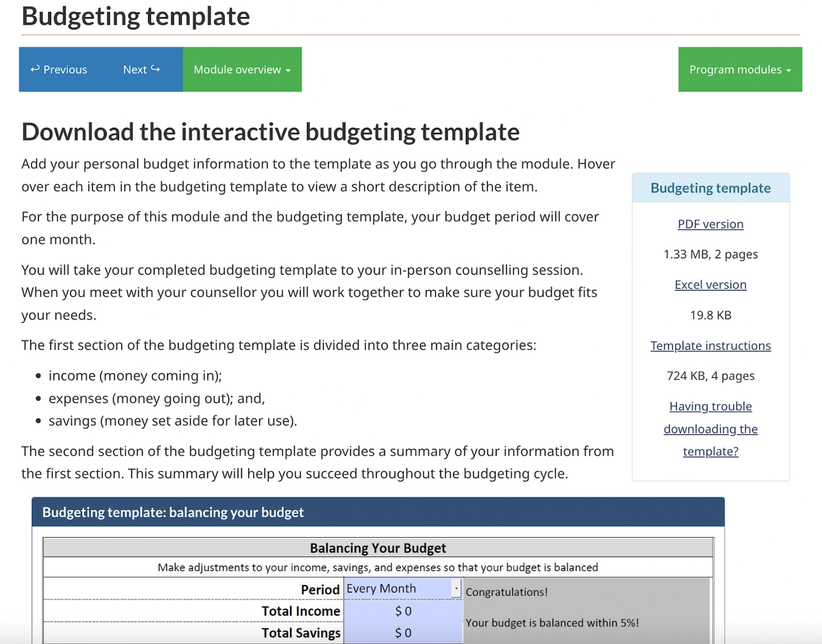

Check out the Financial Consumer Agency of Canada’s budget planner

If you want a slightly more interactive approach to building your budget, the Government of Canada offers free budgeting resources online. In addition to robust guides and tips about budgeting, it also offers a free budgeting template.

But this template can be more helpful because you’ll provide your budget data online, and then the tool will help create a budget for you and offer you a downloadable spreadsheet. It also creates charts to help you visualize your spending habits and provides tips and suggestions.

You can find this interactive budget planner here.

There’s also another online budget template you can try if this interactive one isn’t the right fit for you. This one is a little more basic and easy to use. It asks you to detail your income, expenses, and money being set aside for savings goals, like building an emergency fund.

You can download this budget template here.

Download the MyMoneyCoach.ca free budgeting spreadsheet

My Money Coach is a Canadian website that helps readers learn to get smart with money and reach their goals through budgeting and financial education. It also offers a free budget template tailor-made for Canadians who want to reign in their spending.

This free budgeting template is an Excel spreadsheet that helps visualize your spending as you input your expenses, income, and savings goals. It also lets you easily mark expenses or income cadences as weekly, bi-weekly, monthly, annually, etc. This can make it easier to track expenses and stay on top of all your data.

The My Money Coach budgeting template provides helpful tips as you create your budget so you can maximize your salary to ensure it’s working harder for you.

You can download this budget spreadsheet here.

Why do I need a budget?

If you’re fed up with overspending or always wondering where your money goes each month, you can probably benefit from creating a budget. The good news is, there's a lot of different ways to budget, so you can explore different options to find the right fit for you. And the above templates can help you complete any one of them. Whether you’re budgeting solo or budgeting as a couple, here are some top budgeting methods you can try.

The 50/30/20 method

The 50/30/20 budgeting rule helps you establish guidelines for how much of your money should go to certain expenses. It maintains that 50% of your income should go towards bills and necessities, 30% should go towards non-essential purchases, and 20% toward savings.

This budgeting method is a good place to start if you’re not sure how much you should be spending in certain categories. It’s a favourite millennial budgeting technique, and there are plenty of social media posts about ways to adapt this budgeting technique.

The zero-based budgeting method

If you want to know where every single dollar of your money is going, the zero-based budgeting method might work for you. It’s a bit more intense and requires you to calculate your expenses to the dollar, so that you can create a plan for every dollar that comes into your bank account. The end goal is to have zero unaccounted dollars in your budget template.

This budgeting method can be a bit more rigid than others, but if you’re looking to save money or reduce debt fast, you might give it a try.

The envelope method

With this budgeting technique, you’ll pay for all of your expenses with cash (or cheques) to make it harder to overspend. When your money is digital, it can be easier to part with it. But when you have to physically give it away, you may reconsider your spending decisions.

With the envelope method, you should designate set spending amounts for certain spending categories, like bills, food, subscriptions, and even nights out. The rule is you can only spend what’s in the envelope each month.

If you want to try this but don’t want physical money or envelopes, there are bank accounts that let you separate your money into spending buckets. Some budget apps also allow you to do this to better align with the envelope method.

Plus, you can get creative with this budgeting method. You could budget with a prepaid card to make it harder to overspend. KOHO offers a prepaid virtual mastercard you can sign up for to try out this method.

Ways to make budgeting easy

A budget spreadsheet can help you better visualize your spending activity and savings goals. Keeping track of your spending with a budgeting template can help you stay on top of your finances so you can handle any surprise expense that pops up.

But here are some other ways to make sticking to a budget a little easier.

Automate savings

If saving more money is one goal you want to achieve by using budget templates, you can more easily achieve this by automating your savings. Set up a set amount to transfer from your chequing account into a high-interest savings account every payday. Some savings accounts also offer features like round-ups that can move spare change left over from a purchase directly into your savings account. Be sure to select a type of savings account that earns a competitive interest rate to grow your savings a little bit more.

KOHO offers an alternative savings account that’s a blend of a spending account and a savings account. It earns up to 5% in interest, helping you reach your financial goals a little quicker. KOHO also offers a cash advance to help you avoid steep bank fees. And it comes with credit-building services, like access to your free credit score.

Try a money challenge

If you want to up your motivation for sticking to your budget, you might want to try spending or savings challenges to free up some extra money.

For instance, there are many no-spend money challenges that encourage you not to spend any money for 30 days on non-essential purchases. That means no eating out, buying clothes, or going out for drinks. It might be hard, but it can also help you identify areas where you’re overspending, perhaps without realizing it.

Share your budgeting journey

To keep yourself accountable and actively using your budget template, share your financial journey with family and friends. Let them know what you’re trying to accomplish so they can offer tips and cheer you on.

If you’re active on social media, you can share your money journey there, too, to get motivation and support from like-minded individuals going through the same experience. You might even find a new budgeting template that suits you

About the author

Courtney is a professional writer, editor and financial literacy enthusiast. You can find her writing on CNET, Investopedia, The Motley Fool, Yahoo Finance, MSN and The Balance. She spends her free time exploring different cities across the globe or enjoy some downtime with her two cats and one dog.

Read more about this author