Start building your credit history

We set up a line of credit, you repay it on time, and voilà, you're on your way to building credit history.

Qualify for loans, get yourself a car, or land your dream home, with the help of better credit.

Keep an eye on your credit score, in-app while you build it. And nope, checking it with KOHO won’t affect your score.

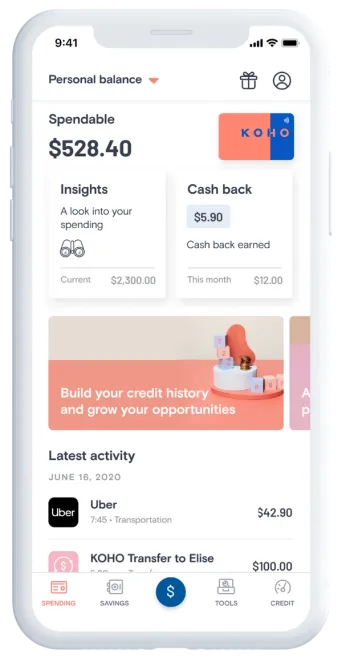

Save and Earn

Get 1% cash back on groceries, transportation, and up to 2% cash back with the Everything plan

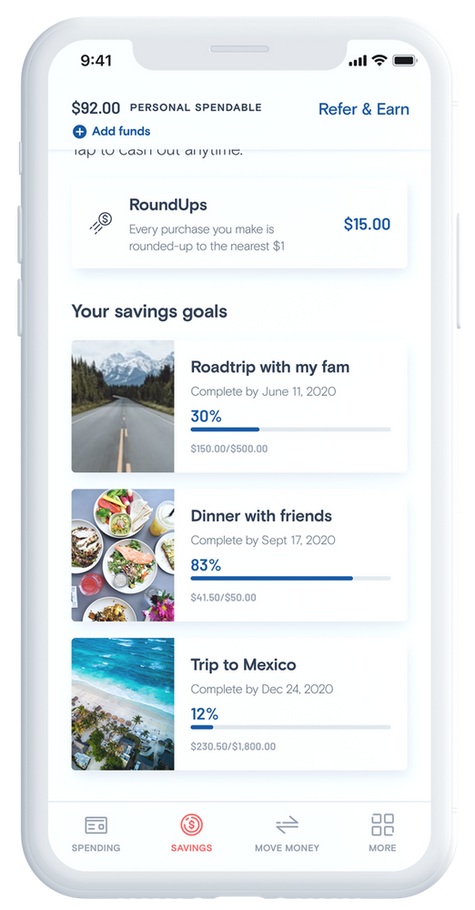

Have our app RoundUp your spare change and stash it away

Reach your goals faster with automated savings

Earn up to an extra 5% cash back at select merchants

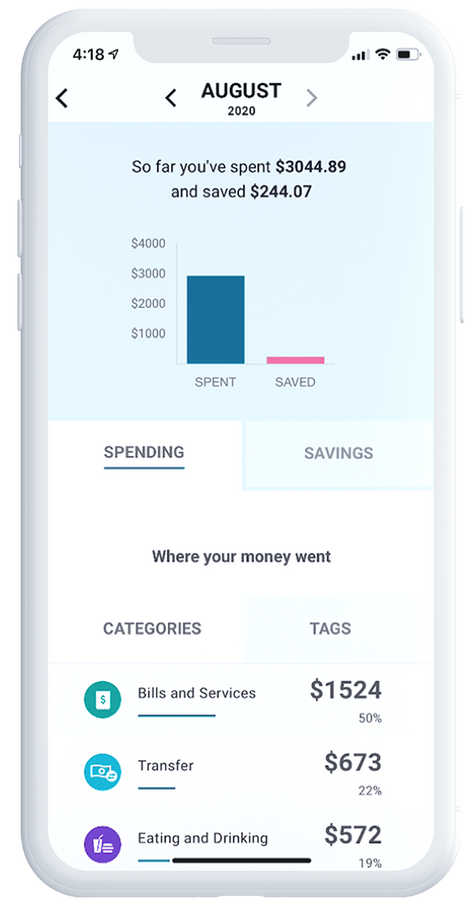

Budget and track

Preload your spending money to make budgeting easy

Get balance updates after each purchase

Use spending insights to stay on track

Get access to included financial coaching

Your money is safe with us

Lock your card anytime in app

Friendly support at your fingertips

A separate virtual card for your online shopping

A federally regulated financial institution holds your funds

Questions?

Your funds are held by Peoples Trust Company, a federally regulated financial institution.

KOHO offers a spending account with a reloadable prepaid Mastercard®. You need to put money into your account, making it more similar to a debit account than a traditional credit card. Yet unlike a debit card, you earn cash back on all your purchases and can use your card wherever Mastercard is accepted (such as online, or worldwide in-store).

You can get your paycheque deposited directly into your KOHO account, or periodically put money into your account. Since you can’t spend more than what’s in your account, KOHO helps you spend smarter, save more, and avoid credit card interest!

We’ve partnered with Peoples Trust, a federally regulated bank to hold any money you load onto your KOHO card. This means that if anything were to happen to us, your money would be safe and you’d be able to access it through Peoples Trust.

Your KOHO card is also covered under Mastercard’s Zero Liability policy. This means that you're fully protected from unauthorized use of your card or account information.

If you place your money in interest-bearing accounts, not only will you get a high interest rate, but your funds will also be eligible for CDIC insurance.

Did you know that Canadians pay an average of $750 in credit card interest per year? With a reloadable card like KOHO, you can’t spend more money than you have in your account. This means you’ll never, ever owe us interest.

The KOHO app helps you manage your money by giving you real-time insights into your spending. There are also savings features that help you to stash away savings without realizing it.

You can use KOHO to pay bills, send free e-Transfers, pay your credit card bill, shop online, get money from an ATM, fund your investment account, and more. There are very few features we don’t have, so why bother paying pesky account fees at another institution?

You can once you’re signed up to our subscription-based over-drafting service, Cover. However, you must be eligible to sign up, so if you don’t see it in the app, continue using KOHO’s other features to better your chance of becoming eligible.

It certainly does, you can use your KOHO prepaid Mastercard to make purchases on the web, in apps, and in stores with Google Pay.

On the website you can see your Spendable balance, send money, add funds, look at your latest transactions, view and cash out cash back, set up direct deposit, access your referral code, as well as chat to user support. On the app you can do more, like sign up for products, like Credit Building, access savings and financial tools, and access account, document, and security settings.

Get a KOHO account

Sign up for a Personal or Joint account (or both!) in minutes.

Open AccountGet Started