Back to learn

Are ATMs Open 24/7?

Written By

Imagine you're strolling through the streets of Canada, and you suddenly need to make a cash deposit or pay bills late at night. The familiar look of an ATM machine offers comfort, promising transactions 24 hours a day.

Whether you're looking to deposit cheques or explore options like transferring money from a credit card and using debit or credit cards for international travel, ATMs seem to promise endless possibilities.

But are they really available around the clock? Dive into this article to find out.

A Closer Look on ATM Accessibility

When considering ATM accessibility, it's crucial to understand that operating hours can vary significantly.

General Operating Hours

Typically, ATMs are accessible 24/7, allowing account holders to perform basic transactions. However, the availability might differ for select ATMs based on location and bank policies.

Factors Influencing Availability

Several factors can influence the availability of ATMs and the services they offer. Let’s take a look:

Location

ATMs in high-traffic areas often offer extended services and other functionality. Conversely, machines in secluded spots may have restrictions.

Bank Policies

Banks might limit access to other ATMs to encourage usage of their own network. This can affect how and where you access your accounts.

Security Measures

Safety is a paramount concern for banks, affecting where and how ATMs are installed. Machines in areas prone to crime may have tighter security measures or limited operating hours, impacting accessibility.

Technical Maintenance

Regular maintenance is necessary to ensure ATMs function correctly and offer the full range of services, from balance inquiries to complex transactions. Scheduled updates can result in downtime, affecting when and how you can access your accounts or utilize other functionality.

Are you wondering about the services available through these machines, such as "can I cash a cheque online" or uncovering "prepaid MasterCard myths"? It's important to note that while some services are standard, others may vary by machine and network.

Credit Union ATMs: A Closer Look

Credit union ATMs stand out by offering unique benefits compared to traditional bank machines. Belonging to one of the largest networks in Canada, these ATMs ensure that transferring funds and the ability to deposit cash are accessible more broadly and with fewer restrictions.

With your credit union debit card, you can access your account through any of the numerous credit union ATMs around the clock, leveraging the convenience of the extensive Ding Free® ATM Network.

Moreover, using a credit union ATM can lead to substantial savings on fees, such as overdraft fees and foreign transaction fees. Credit unions often have lower fees than traditional banks, making them an attractive option for daily transactions and financial management.

National ATM Networks and Accessibility

National ATM networks significantly enhance service accessibility, connecting users across diverse locations, including the Atlantic Region and beyond. The presence of three network identification logos, or "network bugs," on machines signifies a unified system.

These symbols, especially the recognizable yellow hands and globe against the horizon line, guide users to compatible ATMs. The unified approach ensures that whether you're making bill payments or considering shopping with virtual money, you can find reliable service with predictable fees, streamlining your financial transactions nationwide.

Final Thoughts: Maximizing the Benefits of ATMs

Grasping the ins and outs of ATM accessibility and features is vital for seamless financial transactions. Familiarize yourself with various ATM types, network connections, and available services to make the most out of your banking experience.

Informed decisions about ATM use minimize banking fees. Enhance your financial literacy and navigate banking more confidently by consulting our personal finance glossary.

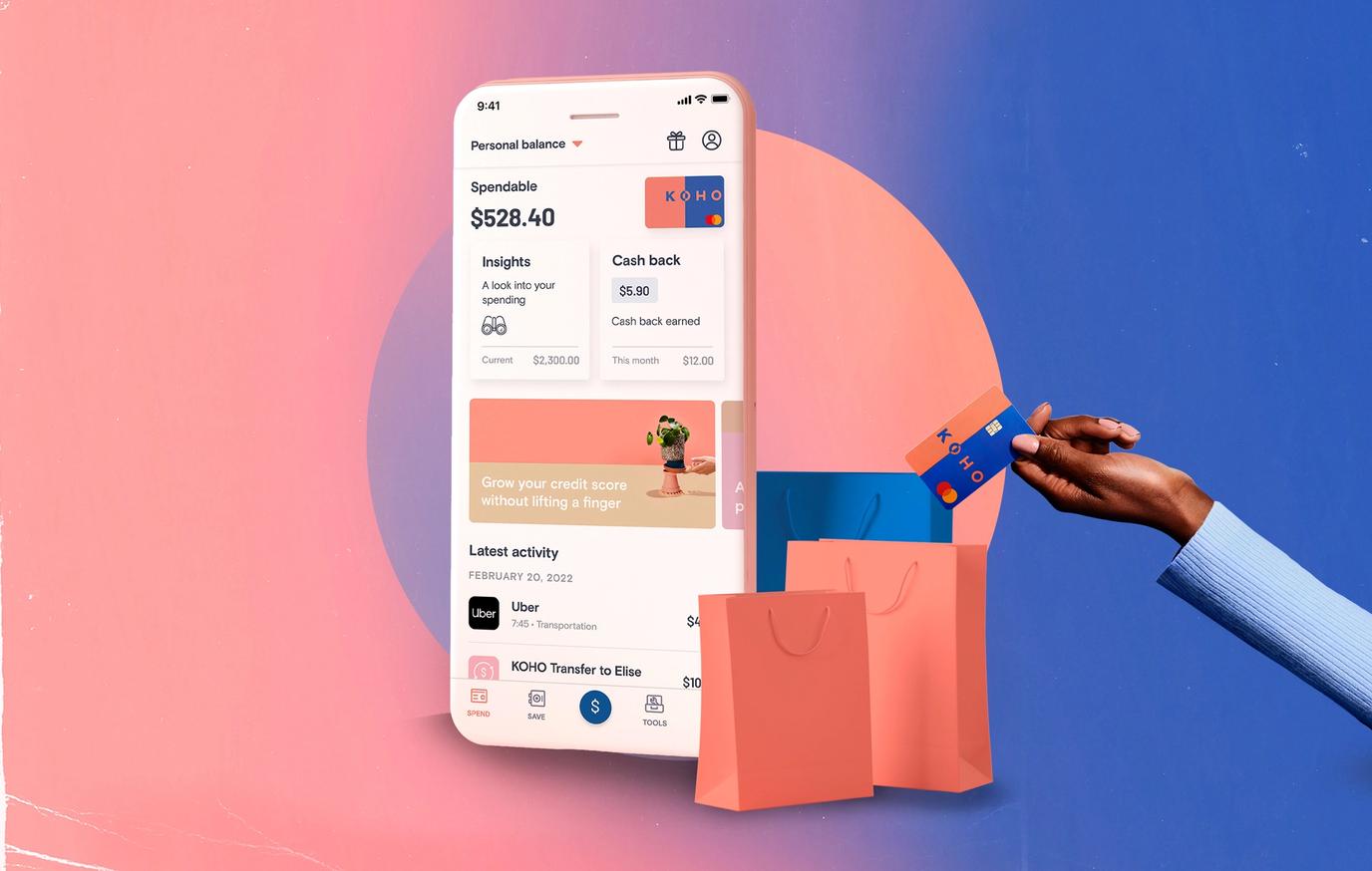

Note: KOHO product information and/or features may have been updated since this blog post was published. Please refer to our KOHO Plans page for our most up to date account information!

Nick Saraev

Nick is a freelance writer and entrepreneur with a particular interest in business finance. He's been featured in publications like Popular Mechanics and Apple News