Newcomers to Canada, you’re in the right place

Whether you’ve just stepped off the plane, or you’ve had a few months to settle in, a KOHO account will make managing your finances in Canada a piece of cake.

Get $20 when you sign up for a free KOHO account with code KOHOKIBBI20 and make your first purchase! Plus, get 3-months of KOHO Credit Building for free*

Newcomers to Canada, you’re in the right place

So, what exactly is KOHO?

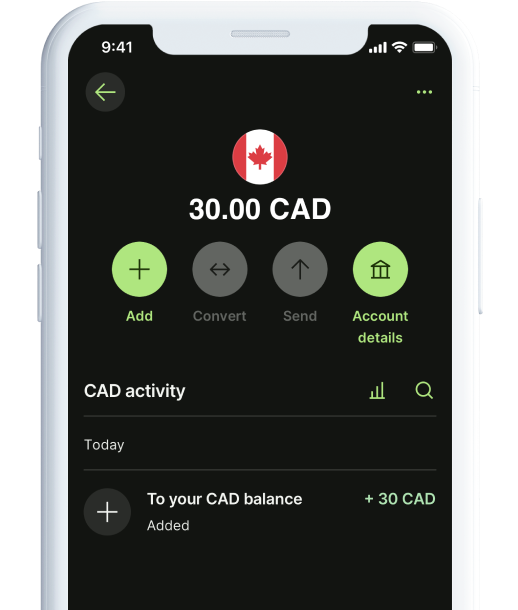

KOHO is a spending and savings account with a prepaid Mastercard.

Sign up for and access through an easy-to-use app, with automatic approval

Load funds and start spending straight away with an instant virtual card

There’s no need for in-person appointments, or piles of paperwork

Download the app once you’re in Canada and set up an account in less than 5 minutes

The need-to-knows

The financial system in every country is a little different, so here’s some things worth knowing about before you get started:

Account types

A chequing account is for day-to-day spending, and a savings account is for setting money aside and earning interest on your balance. Lots of Canadians use what’s called a HISA (high interest savings account) to make the most of the money sitting in their account.

Credit cards

Canada has a credit-based economy. Most people use a credit card for everyday spending and make monthly repayments instead of using a debit card. But this doesn’t mean you have to. If you’re used to using debit, using a reloadable prepaid credit card is a great way to start out.

Credit scores

Your credit score is a 3 digit number that represents your credit history, including your track record of paying off debt or bills. It’s scored between 300-900 and affects your ability to rent, or take out loans. This is one of the most important things for newcomers to work on.

Here’s where KOHO comes in

Build your credit history

Having a good credit score is important for things like renting, or getting loans. KOHO’s Credit Building can help you build your credit history and reach your goals.

Learn More

Access a high interest savings account

A high interest savings account (HISA) is a great way to earn money on your savings over time. Remember, you’ll need to set up your SIN number to start savings with KOHO.

Learn More

Get set up virtually

No need for long phone calls, or finding a branch. You can sign up for your KOHO account on the app in less than 5 minutes before you get your SIN number sorted.

Open account

Proof of Canadian address

Access printable bank statements that you can use as proof of your Canadian address.

Learn more

The best of both a spending and savings account

A KOHO account allows you to have a Spendable balance for day-to-day use, as well as a Vault and Savings Goals that allow you to tuck money away for later.

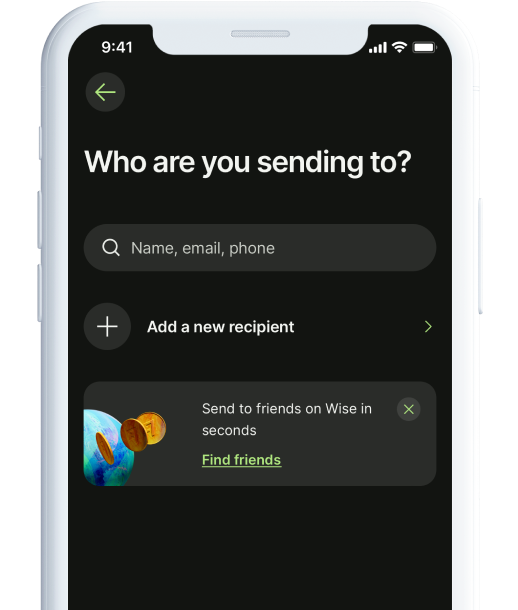

Learn moreReceiving international transfers on KOHO

The easiest way to transfer international funds to your KOHO account is through Wise.

Here’s how you do it:

First, register for a Wise account, online or through the app

1

Next, deposit your money into your Wise account

2

Use the ‘pay someone else’ functionality in the app with your KOHO direct deposit details

3

Once the transfer has been confirmed by Wise, sit back and wait

4

You can find a more detailed step-by-step guide here

Some resources you might find helpful

Getting started with all things money when you move can be mind boggling. Here’s some blog posts that’ll put you a few steps ahead.

Get started in 5 minutes

Join almost 1 million Canadians that love using KOHO

Open an account for freeQuestions?

We’ve partnered with Peoples Trust, a federally regulated bank to hold any money you load onto your KOHO card. This means that if anything were to happen to us (and that’s a big if!), your money would be safe and you’d be able to access it through Peoples Trust. If you place your money in interest-bearing accounts, not only will you get a high interest rate, but your funds will also be eligible for CDIC insurance.

KOHO is a no-fee spending and savings account where you can get instant cash back and earn interest on your entire account. You get a prepaid reloadable Mastercard that gives you all the spending power of a credit card without any fees or interest.

Unlike a credit card, however, the KOHO card draws from funds that are already your money. This key difference makes you spend more mindfully and effectively save more. It’s connected to a smart budgeting app that simplifies day-to-day finances with spending insights and balance updates after each purchase.

The average KOHO user saves 7% of whatever money they load into their account.

It’s pretty simple. You add funds to your KOHO account in one of three ways: e-Transfer from your regular bank account, loading through an existing Visa debit, or by having your work’s payroll directly deposit your paycheque (we call this direct deposit).

Then, you use your KOHO card, either in person or online, to make purchases just like you would with any debit or credit. Plus, KOHO runs on the Mastercard network, so merchants can treat your KOHO card just like a normal credit card transaction.

No, unfortunately you can’t set up your account until you arrive in Canada, but the good news is you can do it virtually once you arrive and have the correct documents required to verify your account. You can find a list of these here.

Once you’re all set up you’ll have a virtual card that you can start using right away.

If you want to send money from your bank account in your home country you can do this using Wise. Here’s a quick guide on how to do it.

Absolutely! You’ll be sent a prepaid Mastercard when you open your account that’s accepted at more than 24 million locations in over 210 countries worldwide. Unfortunately there are some countries where you won’t be able to use your KOHO card to make purchases. You can find the list here.

The big difference is that we’re digital-first. We prioritize financially empowering our users over things like branded ATMs (though KOHO works at any ol’ ATM, and we won’t charge you for using one). Consequently, we can keep our costs low and aim to pass these savings to our users.

Plus, you get 1% cash back on groceries and transportation, and you can make even more when you shop at our brand partners.

Also, our app is pretty awesome.

*Only the users who successfully register a new KOHO account with code KOHOKIBBI20 and make their first purchase over $20 CAD using their KOHO card within 30 days of registration are eligible for the offer and may claim the one-time $20 bonus in their KOHO account. This offer is non-transferable and may only be used once per person. Offer is not applicable in conjunction with other KOHO offers or promotions. KOHO may, at its sole discretion, suspend, terminate or change the terms and requirements of the offer.

Only those users who (i) successfully register a new KOHO Account (“Account”) using the code KOHOKIBBI20 and (ii) subscribe to KOHO Bundle Products using their registered Card (“Card”) in a single transaction, after taxes and applicable fees, within 30 days of registration, are eligible for the offer. This offer is non-transferable and may only be used once per person. To be eligible for the offer, a qualifying purchase for KOHO Bundle Products in a single transaction, after taxes and applicable fees, must be charged to the Card during the offer period and subsequently posted to your Account. The subscription fee paid will be refunded to your Account within 90 days. You can earn a maximum of three (3) credit/s to a maximum of $30 (CAD) in credits per Card during the offer period based on three (3) consecutive month subscription fee payments. In the case of a purchase made during the offer period, it may not qualify if the Card is charged by the merchant on a different date and that date occurs after the offer ends. KOHO Bundle Products subscriptions are subject to KOHO User Agreement terms. (available at https://www.koho.ca/legal/?ver=mastercard#CardHolderAgreement). You must be at least 18 years of age, or the age of majority in your jurisdiction of residence, to subscribe to KOHO Bundle Products. Please note if you purchase a subscription, unless you notify the merchant that you want to cancel, your subscription will automatically renew on a monthly basis for another subscription period of equal length and you will be charged the then-current price for the subscription. You can cancel your subscription at any time before the end of the current billing period or promotional offer period, subject to KOHO User Agreement terms.