Back to learn

Why Was My Card Declined?

Written By

Cash's decline as a primary payment form has become more apparent than ever. As technology advances and alternative payment methods rise, money has gradually evolved.

From the bartering system of ancient civilizations to the introduction of coins and paper currency, cash has been a symbol of humanity's adaptability and ingenuity.

Fast forward to the present day, and cash is no longer king. Only 6% of Canadians now exclusively rely on cash for their transactions.

With superior convenience and security, alongside the common credit card perks, it's no wonder that we've become increasingly reliant on electronic payments.

However, with this reliance comes the occasional frustration of card declines. Being declined at the checkout line is the worst. In this guide, we'll delve into the reasons behind card declines, how to handle them well, and practical tips to avoid them altogether.

What is a card decline?

Picture using your first credit card at your favorite cafe, eager to get your morning coffee. You confidently swipe your card, only to see the dreaded words: Card declined. Panic sets in as you wonder what went wrong and how to handle the situation. We can all relate to the moment of vulnerability from a card decline.

The approval of a transaction means that your credit card issuer has confirmed the existence of your account and that there are sufficient funds to handle the transaction. A card decline, on the other hand, occurs when your attempt to make a purchase with your credit or debit card is unsuccessful.

So, why was your card declined? A card decline can be categorized as either soft or hard, each with its own implications for the transaction.

Soft decline: This occurs due to a temporary authorization failure. In most cases, this is a minor issue, and the transaction will go through successfully on the second attempt. A momentary communication glitch between the merchant and the card issuer or incorrect input of card details could cause it.

Hard decline: This type of decline indicates that the bank or card network deliberately blocked the transaction. It suggests a more significant issue to fix before you can use your card again. Hard declines include insufficient funds, security concerns, or expired cards.

When a card decline happens, it's important to first remain calm. Consider an alternative payment method or resolve any issues that may have caused the decline.

Contact customer service or check your bank account balance to determine the reason for the declined card and take appropriate action to address it. There should be a customer service phone number on the back of the card for easy reach.

Let’s take a closer look at some reasons a card might be declined.

1. Incorrect payment information

Mistakes happen, especially when manually entering your card details. It's not uncommon to unintentionally mix up a few numbers. Incorrectly entering even a single digit of your card number or expiry date or having an outdated billing address can lead to a declined transaction.

If you make multiple mistakes, your issuer might freeze your account as a precaution. Whenever there is a misunderstanding, you should reach out to your issuer. Additionally, updating your issuer immediately whenever your address changes is important, as having up-to-date personal information reduces the risk of fraud.

To avoid this, review the details of your credit and debit cards carefully before finalizing any purchase.

Always double-check details such as the:

Card number

Expiration date

Security code

Billing address

If available, consider using convenient checkout options like Google Pay, Samsung Pay, and Apple Pay to streamline the process and reduce the chances of input errors.

2. Card limits

Card limits affect both credit and debit cards, each with its own set of considerations.

Credit limit

Reaching your credit limit or ‘maxing out’ will result in your credit card being declined. Your credit card has a maximum spending threshold known as the credit limit. Exceeding this limit or reaching it can lead to declined credit card transactions.

Low credit limits can pose challenges, particularly for those with limited credit history or lower credit scores. About a third of millennials have faced rejections due to credit score-related issues when applying for various financial products.

Manage your spending habits responsibly to avoid declines due to reaching your credit limit. A good rule of thumb is to use less than 30% of your credit line.

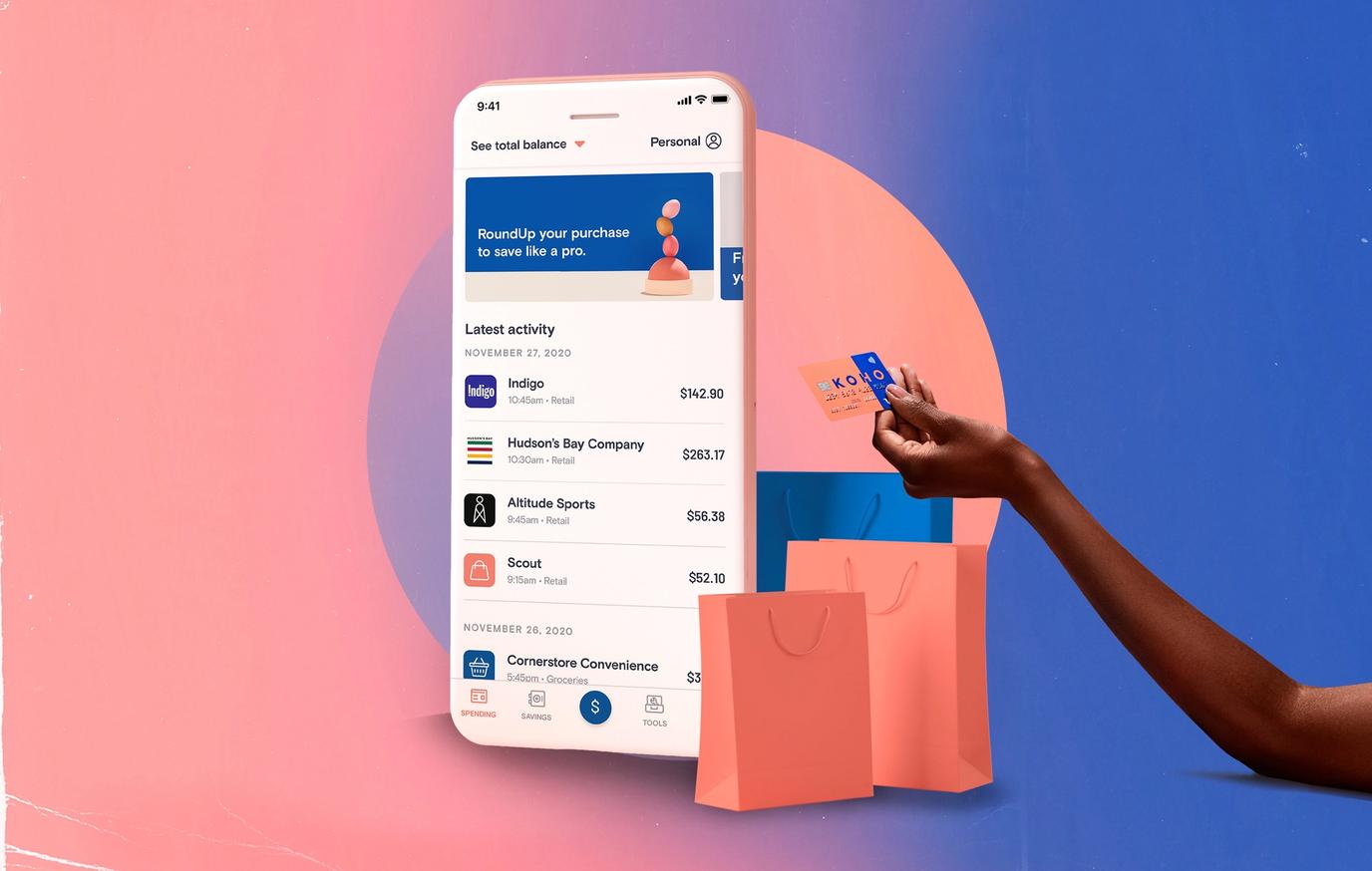

You can also build your credit with KOHO. We offer a virtual credit card and secured credit building. Starting with a free credit score check can provide insights into your credit health and guide your efforts toward building better credit.

Debit card limits

Unlike credit cards, debit cards are linked directly to your bank account, restricting spending to the available balance. Insufficient funds are often the main reason for a debit card decline, occurring when there isn't enough money in your account to cover the transaction.

This might happen if you've miscalculated your balance or if there have been recent purchases by a family member that you weren't aware of. Some banks offer overdraft protection coverage, allowing a debit card transaction to go through. It's important to check with your bank for availability and terms.

Many debit cards also have daily withdrawal limits, limiting the available funds you can spend in a single day. These limits serve as a safeguard against potential theft or unauthorized transactions.

If a fraudster gains access to your card, the limit prevents them from draining your entire account at once. Exceeding this limit may trigger declined transaction attempts, emphasizing the importance of staying within your daily withdrawal boundaries.

Understanding and adhering to these limits helps ensure smooth and secure transactions while using your debit card.

3. Card not accepted

Not all merchants accept every type of debit or credit card, which can lead to declines at checkout.

Some merchants only accept specific card networks like Mastercard or Visa, while others may accept a broader range. Attempting to use a card that the merchant does not support can result in automatically declined debit card transactions. This limitation applies to both physical and online transactions.

For instance, trying to swipe a card at a chip-enabled terminal may lead to a decline if the merchant does not support that type of transaction.

Similarly, certain merchants may not accept a virtual credit card, even though it offers benefits like enhanced security and privacy. While virtual credit cards are advantageous for online transactions, not all banks issue them, and not all merchants are equipped to process them.

Additionally, in-store returns can be challenging with virtual cards due to the lack of a physical card for processing. It's best to have alternative payment methods on hand, such as another card or physical cash, just in case your preferred card type is not accepted.

4. Expired card

Credit and debit cards typically have expiration dates printed on them, indicating the month and year until which they are valid. When a card expires, it becomes inactive, and the card issuer or payment network declines attempted transactions.

Using an expired card for transactions is just like using an outdated form of identification. For this reason, you should check your cards' expiration dates every so often and replace them before they expire.

Contact your financial institution to request a replacement card. Most banks automatically issue new cards with updated expiration dates before the old ones expire, but it's wise to confirm this and confirm timely receipt of the replacement card.

You should also update your card information with any merchants or services that have automatic payment arrangements to avoid losing access to your subscriptions.

5. Inactive account

If you attempt to use a card that has been dormant for some time and it gets declined, it's possible that your account has been closed due to inactivity.

Be aware that financial institutions may close inactive accounts which haven't been used for a specified period, often several months or years.

To prevent your account from being closed unexpectedly, consider setting up automatic payments for regular expenses and ensuring these payments are paid in full each month.

6. Late payments

Getting your credit card declined can be caused by failing to pay on time. Even if you're an authorized user, missed payments on your credit card account can result in various penalties and repercussions. These may include:

Late payment fees: Credit card issuers typically charge a fee when you fail to make the minimum payment by the due date. This fee can vary depending on the issuer and the terms of your card agreement.

Interest charges: Late payments can trigger an increase in your interest rate. If you miss a payment, your issuer may apply a penalty APR, a higher interest rate that applies to your existing balance and future purchases. This higher rate can significantly increase the cost of carrying a balance on your credit card.

Negative impact on credit score: Payment history is one of the most important factors in determining your credit score.Getting a credit card with bad credit can make it more difficult to qualify for a credit limit increase in the future and may result in higher interest rates on loans.

Account restrictions: Along with financial penalties, late payments can restrict your account. Your credit card issuer may impose temporary freezes or limits on your account until the past-due amount is paid. This can prevent you from making additional purchases or accessing credit until the issue is resolved.

Collection actions: If late payments persist and your account becomes severely overdue, your issuer may take further action to recover the debt. This can include assigning the account to a collection agency, resulting in collection calls, letters, and potentially legal action to recover the outstanding balance.

Late payments on your credit card can have serious financial consequences and negatively impact your creditworthiness. Improve your spending habits with timely payments to avoid these repercussions and maintain a healthy credit profile.

If you're struggling to make payments, consider contacting your credit card issuer to explore options for hardship assistance or payment arrangements.

7. Travelling

Buying something from an unfamiliar location can raise suspicions of fraud, prompting your bank to decline the transaction. When travelling particularly to another country, it's advisable to inform your bank in advance to prevent card issues.

Transactions made in different cities or countries may trigger fraud account alerts, leading to account locks to safeguard your funds. To avoid disruptions while travelling, notify the bank and card issuer of your itinerary beforehand and consider having alternative ways of paying or carrying multiple cards as backups.

8. Large purchases

Going on a spending spree or making a big-ticket purchase can raise a big red flag with your credit card company. They do this to keep an eye out for anything fishy and protect you from potential fraud.

If you're planning on making a purchase that's out of the ordinary for you, it's a good idea to give your credit card company a heads-up beforehand. You can also consider asking for a credit limit increase if you regularly make big purchases to avoid any hiccups at checkout.

9. Suspected fraud

Your credit card company is always on the lookout for any signs of suspicious activity to keep your account safe. This could include large purchases that don't match your usual spending habits, transactions from places you don't typically shop, or deliveries to addresses they don't recognize.

While it's great that they're keeping an eye out for you, it can sometimes lead to your account being temporarily frozen. To avoid any unnecessary hold-ups, make sure to communicate any changes in your spending habits to your credit card company.

Also, keeping your customer records up to date and staying on top of any outstanding debts can help prevent your account from being flagged for fraud.

10. Technical Problems

Sometimes, technology just doesn't play nice. Whether it's a glitchy terminal, a power outage, or a slow internet connection, technical difficulties can throw a wrench in the works and lead to declined transactions.

While these problems are usually temporary, they can still be frustrating for everyone involved. If you encounter any technical issues while trying to make a purchase, it's best to stay patient and try again later. If the problem persists, don't hesitate to make a quick call to your bank or financial institution for assistance.

What to do if your card is declined

If your credit card was declined, don't freak out! It can be a hassle, but there are steps you can take to resolve the issue:

Remain calm: Stay composed, and don't let the situation stress you out. Card declines can happen for various reasons, and most of the time, they're easily fixable.

Verify information: Double-check the information you entered, including your card details and billing address. Sometimes, a simple error in inputting information can cause a decline.

Try again: If your card is declined, attempt the transaction again. It could be a temporary issue that resolves itself on the second attempt.

Contact your bank: If the problem persists, contact your bank or financial institution. They can explain why your card was declined and offer guidance on resolving the issue.

Check for alerts: Some banks send alerts or notifications when a transaction is declined. Review any messages you receive from your bank for additional information.

Use alternative payment methods: If your card continues to be declined, consider using a different payment method, such as another card or a mobile payment option.

Address the issue: Once you understand why your card was declined, take appropriate action to address the underlying problem. This may involve updating your payment information, resolving outstanding issues with your account, or contacting your bank for further assistance.

Remember, card declines are often temporary setbacks that can be quickly resolved with a bit of patience and proactive communication with your bank.

How to avoid card declines

There are steps you can take to minimize the likelihood of your card being declined in the future. Here are practical tips on how to avoid card declines and handle your financial transactions with ease.

Monitor your account balance: Keep a close eye on your account balance to ensure you have sufficient funds to cover your purchases. Regularly checking your balance can help you avoid accidental overdrafts and potential declines.

Update your contact information: Make sure your bank has your current contact information, including your phone number and email address. This way, they can reach out to you quickly if there are any issues with your account or suspicious activity.

Notify your bank of travel plans: If you plan to travel, especially internationally, inform your bank beforehand to prevent any unexpected declines because of unfamiliar transactions.

Keep your card information secure: Safeguard your card details and personal information to prevent unauthorized use. Avoid sharing your card number, expiration date, or security code with anyone, and be cautious when making online purchases on unfamiliar websites.

Use trusted merchants: Stick to reputable stores and websites when making online purchases. Look for secure payment gateways and verify the authenticity of the website before entering your card information.

By following these simple tips, you can minimize the chances of experiencing card declines and enjoy smoother, hassle-free payments.

Final thoughts

Experiencing a card decline can be stressful, but understanding the reasons behind it can help you address the issue effectively. Whether it's because of factors that affect your credit score, insufficient funds, or even suspected fraud, there are steps you can take to resolve the situation and prevent future declines.

Don’t forget communicate with your bank, keep your information secure, and remain vigilant to ensure smooth and painless transactions in the future.

Note: KOHO product information and/or features may have been updated since this blog post was published. Please refer to our KOHO Plans page for our most up to date account information!